Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

Understanding How Relative Volatility Index Works

What is Relative Volatility Index?

The relative volatility index (RVI) refers to an indicator that measures the bullish or bearish strength of volatility of a stock or currency in trading. Donald Dorsey developed a Relative volatility index indicator by using the standard deviation of prices.

RVI indicator identifies the volatility of buyers or sellers and plots it on the chart with a value range from 0 to 100. It indicates the volatility of a security only.

RVI Formula

RVI formula uses the standard deviation of prices instead of using closing prices like in the relative strength index formula. To calculate the RVI, calculate the U and D and then put the value of U and D in the RVI formula.

U = average of the sum of standard deviations for bullish candlesticks

D = average of the sum of standard deviations for bearish candlesticks

What is standard deviation?

RVI formula uses standard deviation. It means RVI checks the deviation of price from the mean value. For example, in EURUSD, if the mean value is 1.3211 but the price shows a bullish deviation of 50 pips from this mean value in a single day. Then it simply indicates the direction of volatility is bullish.

How relative volatility index works?

The relative volatility index ranges from 0 to 100. It represents the volatility of a currency pair or stock.

- RVI value close to 100 means buying volatility is greater and it confirms that you should trade in buy direction.

- Index value close to 0 means selling volatility is greater and you should trade in sell direction.

RVI is not a single indicator to use for selling or buying signals. It only shows the direction either bullish or bearish.

It suggests you trade in a particular direction only and stay away from the opposite direction. For example, if RVA is greater than 50, then this indicator is suggesting you trade in the bullish direction only. Because volatility is in the direction of Bulls.

If you will trade in the direction of volatility, then there are higher chances of winning a trade. That’s why it acts as a confirmation indicator like candlestick patterns act as a confirmation signal in price action trading.

How to trade using RVI indicator?

RVI indicator alone cannot be used to trade that’s why it is always used as a confluence in any other trading strategy.

Here I will use the RVI indicator with the RSI indicator and will explain a strategy using both indicators and some other important parameters of the relative volatility index. The main purpose is to explain to you the working of RVI in trading.

Buy Signal

There are few parameters you need to follow to get a buy signal in the market using RVI and RSI indicators.

Buy a currency pair or stock if

- RSI is below 30

- RVI is above 60

Exit buy trade if

- RVI value falls below 40

This is a simple trade setup using a relative volatility index. The logic behind it is that RSI below 30 indicates oversold condition and RVI above 60 indicates bullish direction. Both conditions met and it triggered a buy signal.

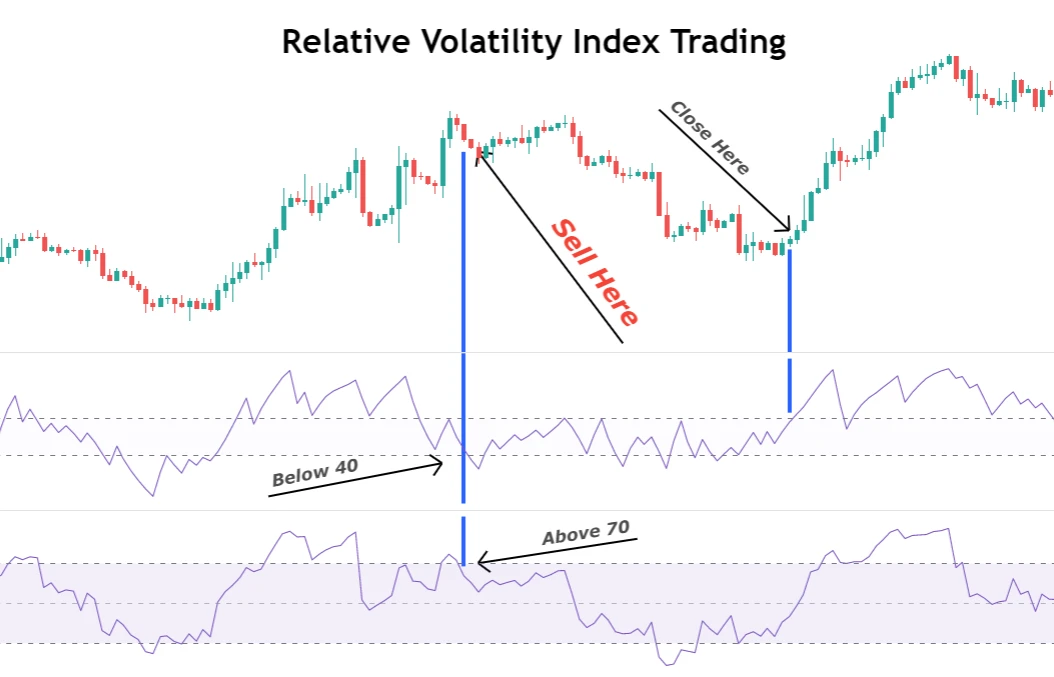

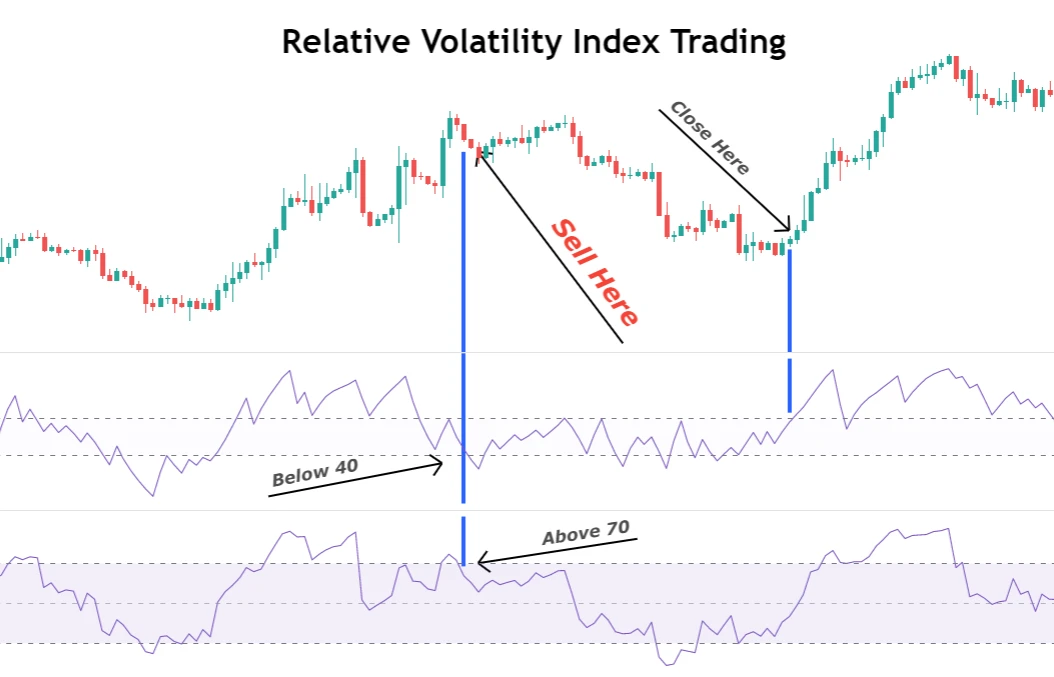

Sell Signal

Sell stock or currency if

- RSI is above 70

- RVI is below 40

Exit sell trade if RVI value approaches 60.

The psychology behind this strategy is that RSI above 70 indicates an overbought condition and it gives a sell signal. In the RVI, a value below 40 also indicates the bearish direction. We confirmed the direction using RVI and get a signal using RSI.

Difference between RSI and RVI

The difference between the relative strength index and relative volatility index is that

- RSI indicator uses closing prices of candlesticks whereas RVI indicator using standard deviation of prices from mean value.

- RSI is used to get a sell or buy signal where as RVI indicator is used to get direction only.

Conclusion

Both will give good results if they are used in the correct way. For example, use a relative strength index to get a signal and relative volatility index to confirm the direction of the signal.

The relative volatility index is a good indicator but without any confluence, it has no worth in trading.