Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

Three Outside Up Candlestick Pattern: With Trading Strategy

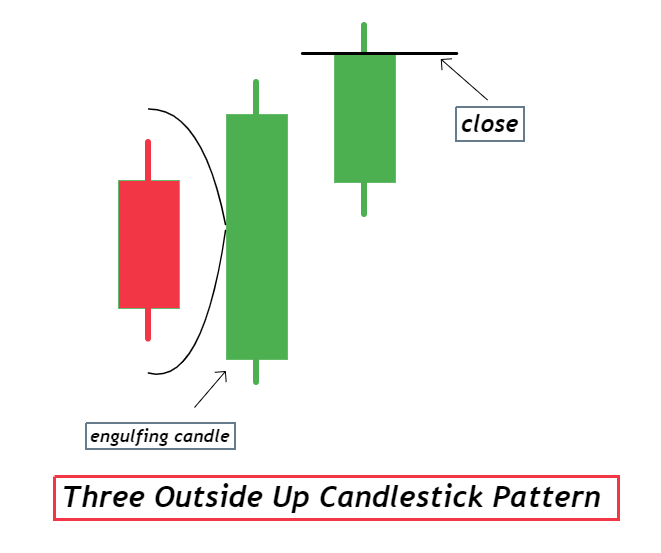

Three Outside Up candlestick pattern is defined as a three candles bullish reversal pattern in which after a bullish engulfing pattern, a third bullish candlestick confirms the reversal signal. It is the opposite pattern of three outside down.

This pattern usually appears in a downtrend pattern, where prices of the assets show a tendency for a dip in the market.

How to identify the Three Outside Up Candlestick?

You can identify the Three Outside Up Candlestick Pattern in three steps.

Step 1:

A bearish nature candlestick of medium size with almost equal upper and lower wicks will appear on the chart.

Step 2:

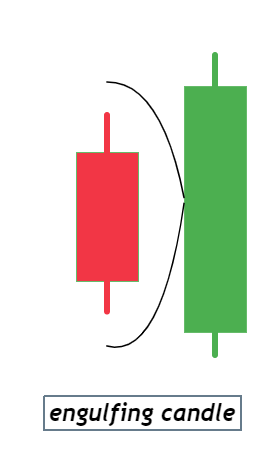

A longer white candle with having bullish nature will appear next to the first bearish candle. This candle exhibits a pattern that shows engulfing of the first candle. The upper and lower wick of the second candle is also similar in their lengths.

This step is essential as it can cause confusion because, at this step, the pattern resembles the two-line bullish candlestick pattern. To confirm the three outside pattern we need to wait for the third and final step.

Step 3:

In this step, a bullish candle stick appears next to the second candlestick. This third candlestick is smaller in size as compared to the second one. The important thing is the close of the third candle is always at a higher level than the close of the second longer bullish candle.

The positioning of the third candlestick’s close is the crucial point in confirmation of the pattern.

If the close of the third candlestick pattern is not situated above the close of the second candlestick. The pattern is not regarded as the three outside up pattern.

| Features | Description |

|---|---|

| Number of candlesticks | The pattern is composed of three candlesticks. The first candle is bearish The second and third candles are bullish |

| Prior Trend | The prior trend to this pattern is a bearish or downtrend. |

| Forecast | It is a bullish reversal pattern. This means the bulls are gaining power, and bears are going to fade in the near future. The market will try to find new peaks following the appearance of this pattern on a candlestick chart. |

| color | The first candle is black in colorThe second and third candles are white in color, exhibiting a bullish nature. |

The activity of market makers during the formation of three outside up pattern

This candlestick pattern is powerful and has a significant reputation in the market in terms of its success ratio. As mentioned above, this candlestick pattern follows a downtrend which means it appears in a bearish trend.

The appearance of the first bearish candlestick suggests the continuation of the already dipping market. The appearance of the second bigger bullish candle warns the traders that the market may take a reversal turn. At this stage, the number of buyers significantly begins to increase. The third and final step is the appearance of the third bullish candlestick. The upper close position of the third candlestick pattern informs traders that sooner the bullish sentiment is going to prevail.

As the pattern confirms, the number of buyers is significantly in control.

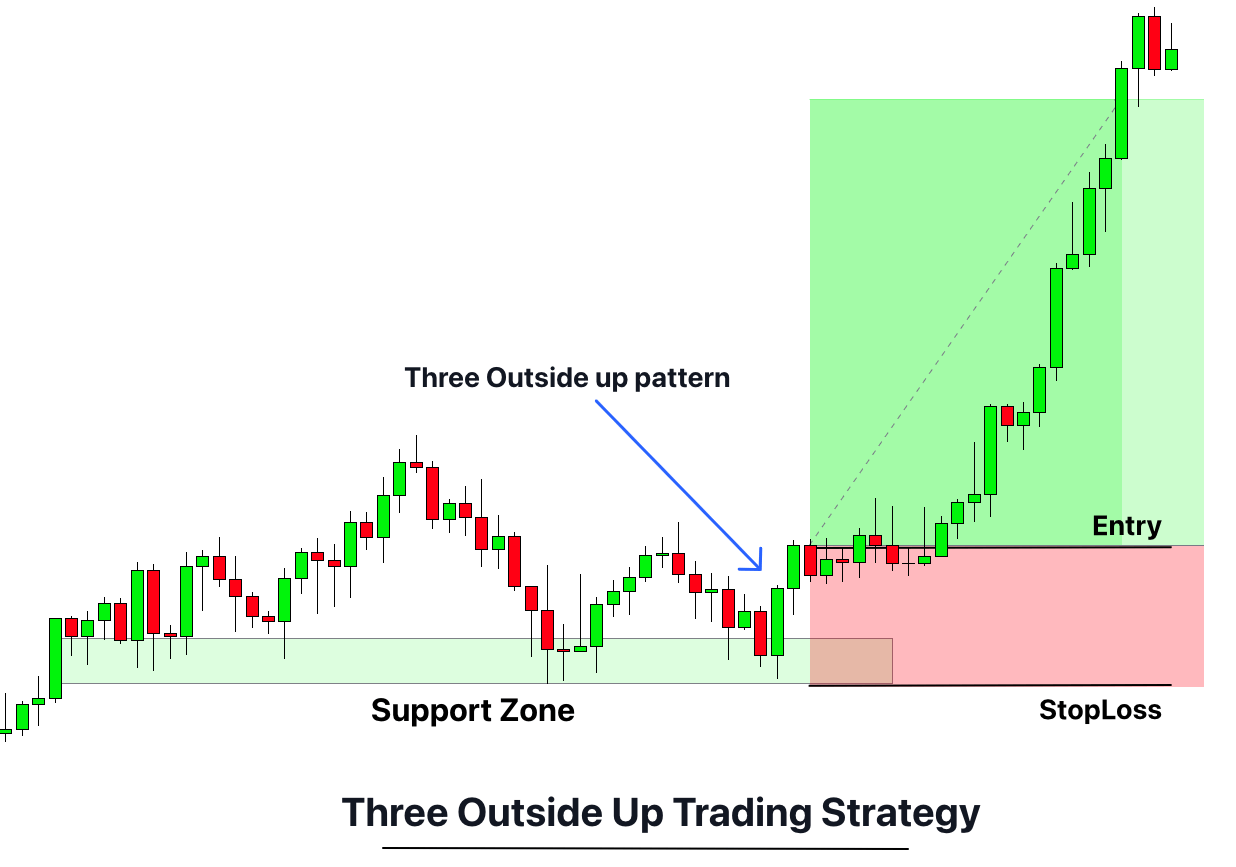

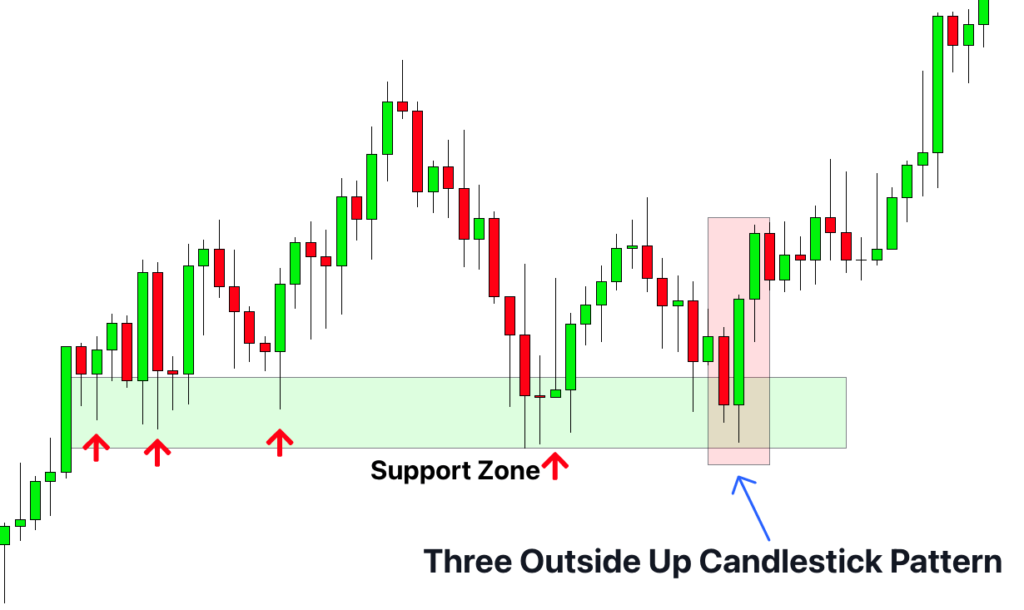

Confluence of Support zone

This pattern exhibits a 35% success ratio in general. The confluence of the support zone in forming a trading strategy with three outside up candlestick pattern can significantly increase the success ratio.

You have to follow the below-mentioned postulates to trade this pattern with the confluence of the support zone.

- Support level formation on the chart.

- The price need to take a dip until it touches the support level drawn earlier.

- Wait for the appearance of the candles of the pattern at the support level

- Once the price follows the uptrend and breaks the high level of the third candle, place your trade.

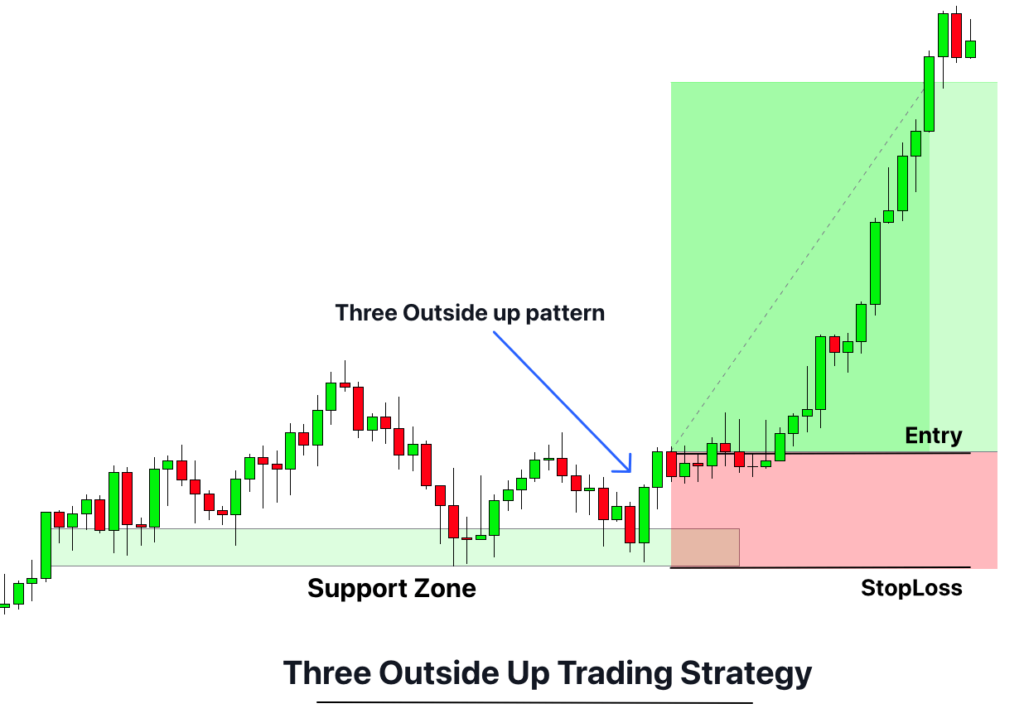

How to trade the three outside up candlestick

The location of the pattern in a candlestick pattern is highly important in this case.

Once the pattern is confirmed, you can make your move.

Entry

The best to open a trade when dealing with three outside up pattern is when the close of the third candle is finishing. It confirms the future rise in the market, thus increasing your chances to make better moves in the future bullish market.

Stop loss

As you know, risk management is very vital in a trading market. You have to place the stop loss just below the low of the second engulfing candle.

Take profit

The pattern shows a high level of success when traded with the confluence of the support zone. So to take profit level, you can use the resistance zone or a trailing stop indicator to close the trade in profit.

The bottom line

Three outside up candlestick pattern is a frequently found pattern with a moderate success ratio. The rate of success increases significantly when formed near the support zone.

The pattern is composed of three candles. The first candle is a bearish one, followed by a longer engulfing bullish candlestick. The third candlestick is a medium-sized candle with a higher close level to its prior candle.

Though it s a good pattern with a decent success ratio, I don’t recommend relying on this pattern alone.