Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

Rising or Falling Wedge Pattern in Forex Trading

Wedge chart pattern in forex refers to a reversal chart pattern that consists of two trend lines and indicates a decrease in momentum of price trend with the time. Price structure resembles a rising or falling wedge pattern. Like first swing will be the biggest one and then next will be smaller and so on until a trend line breakout will happen against the trend.

This chart pattern is most widely used in forex technical analysis. Wedge pattern in forex is categorized into two types.

- Rising wedge pattern

- Falling wedge pattern

Rising Wedge Pattern

Rising wedge or ascending wedge pattern in forex is a reversal chart pattern that predict the upcoming reversal in bullish trend. It is a bearish chart pattern in forex technical analysis.

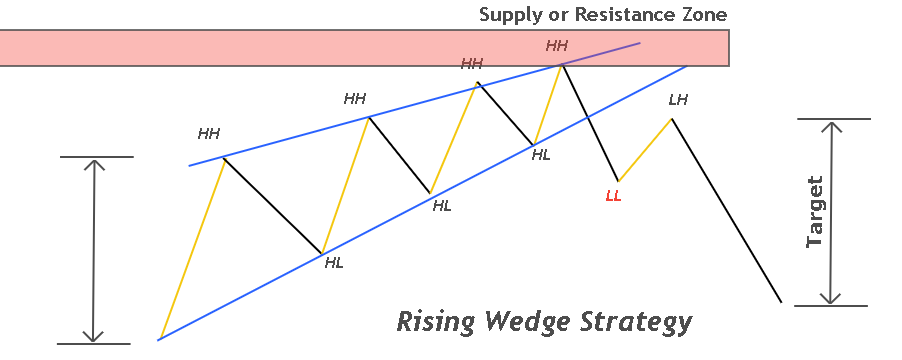

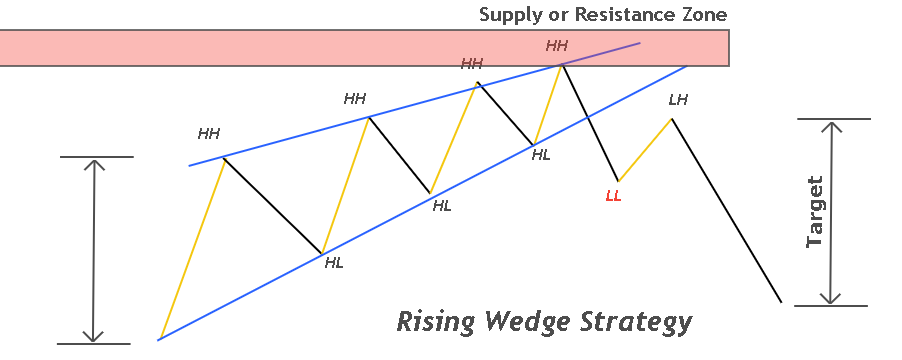

- Draw two trend lines. The first trend line will meet the higher lows of swings in upward direction. Then the second line will meet the higher highs of swings in upward direction. This will form a rising wedge like pattern. Look at the image below.

- Now the next step is to look for breakout of the first trend line in the ascending wedge. Price will continue consolidating until a breakout of trend line will happen. After breakout, price will change its trend from bullish into bearish. A formation of lower low after breakout of trend line is a plus point.

As rising wedge pattern is very common nowadays. So there can be many false breakouts. We can avoid these false breakouts by filtering best trade setups only. I have explained below a strategy to trade a wedge pattern effectively.

Falling Wedge Pattern

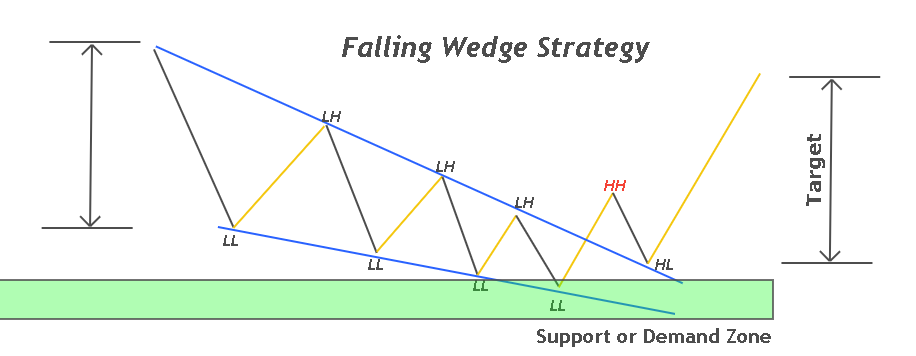

Falling wedge or descending wedge pattern in forex is a reversal chart pattern that predicts reversal in trend from bearish into bullish. This pattern is formed by drawing two downward trend lines. Draw the first trend line by connecting the swing lower lows, and then draw the second trend by connecting the swing lower highs.

It will form a falling wedge like shape.

After downward consolidation, a breakout of trend line in bullish direction will occur. Consolidation is a symbol of upcoming impulsive move in the price. After trend line breakout, trend will be reversed from bearish into bullish.

Rising wedge trading strategy

Trading only wedge pattern will not make you profitable in forex until you will trade it with confluences. Confluence in forex is the use of another technical parameter with the strategy to enhance its winning rate.

For example, use of MACD and RSI divergence with the rising wedge pattern will enhance its winning rate or just use support and resistance or supply and demand as a confluence to trade this pattern. I will explain both by use of indicator and by use of price action. I will prefer pure price action trading.

MACD and RSI divergence

When price will form higher highs and also continue consolidation inward like a wedge corner, then there must be divergence on RSI and MACD indicator. Divergence also indicates upcoming reversal. That’s why we will use wedge pattern breakout and MACD and RSI divergence as a confirmation.

If there is no any divergence on MACD and RSI, then we will skip that wedge pattern.

Key levels

This is the recommended method to use with rising and falling wedge pattern. Price action is the best strategy in forex trading. For example, use of supply and demand or support and resistance zones with rising or falling wedge will increase the winning ratio of this setup. Because there are many chances of reversal from a key level.

Like if there is forming a rising wedge pattern and there is also a strong resistance or supply level above then if Price break trend line after touching the resistance and supply level then it is a good pattern. If Price break the trend line without touching resistance or supply level, then it can be a false breakout to trap retail traders.

This is the simple use of key levels. Now let’s talk about the stop loss, take profit and entry of trade setup.

Stop loss

Stop loss will be above the last high made by the price before breakout of trend line in case of rising wedge chart pattern. Make sure to add spread while adjusting the stop loss level.

Stop loss can also be placed above the key level which will be a more safe option but as we also have to look for a good risk reward that’s why first one is good.

Entry

There are two options here, either to trigger a trade just after breakout of the trend line or to wait for retracement to the Fibonacci 50 level. Here you will use your common sense and calculate risk reward ratio for each case. And then you will decide yourself which one option will be good.

Keep in mind, breakout candlestick must have at least 70% body (means small wick and big body).

Take profit

Take profit level is mirrored by measuring the height of the first swing wave in a rising or falling wedge pattern. Like in the image below. You can also split it into two take profit levels. One at the origin and the next one at the 1.272 Fibonacci extension level to maximize profits.

Reading Price Action is the Best Strategy