Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

Introduction to Three Inside Up and Three Inside Down Pattern

A candlestick pattern that consists of three candlesticks (two opposite and one inside bar) which form in a specific sequence and indicate a trend reversal in forex trading is called three inside up/down candlestick patterns.

- Three inside up

- Three inside Down

The best thing about this pattern is the formation of the third candlestick that act as a trend reversal confirmation candlestick.

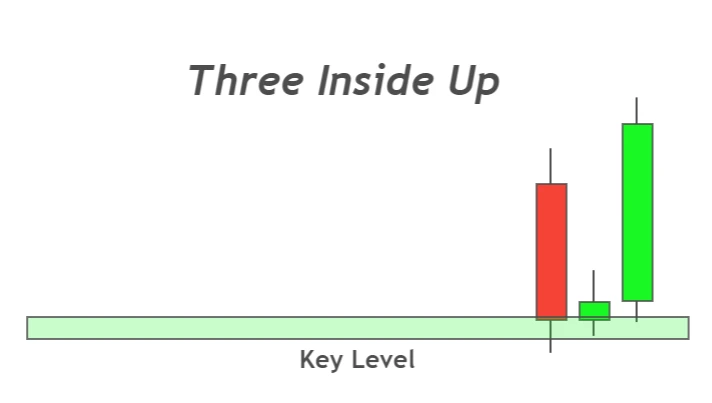

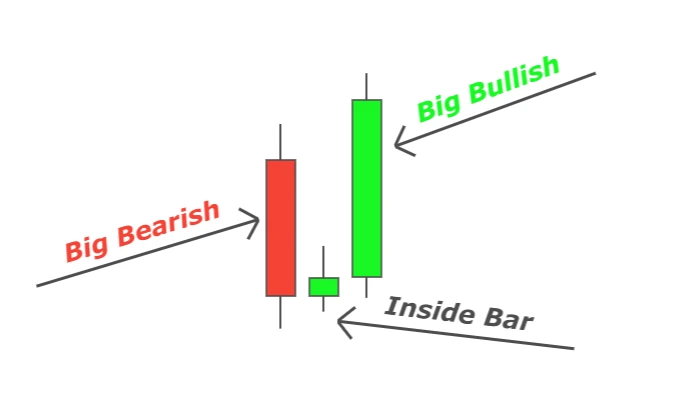

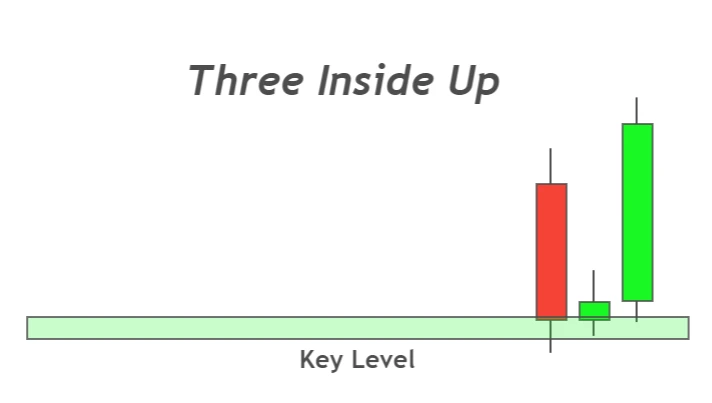

Three inside up

It represents a bearish trend reversal and resembles a morning star pattern. When it forms at the end of a bearish trend then it will indicate the end of the previous trend.

It consists of three candlesticks

- Big bearish candlestick

- Inside bar candlestick

- Big bullish candlestick

how to find out three inside up pattern

There is a specific criterion you must follow to find a three inside up candlestick pattern. Candlestick in the pattern must form in the proper sequence.

- The bearish candlestick must have body ratio greater than 60% (big body candlestick)

- Body of inside bar candlestick must be small (optional)

- Bullish candlestick must close above the high of the previous bearish candlestick

The beauty of this pattern is that there is no need for confirmation of breakout like in other single or double candlestick patterns. Because the third candlestick represents breakout of high of the inside bar and bearish candlestick. This characteristic makes this pattern trustworthy.

Conditions for a good three inside up pattern

There are a few special conditions of three inside up pattern that helps to filter out poor patterns from the crowd on the chart.

- A pattern that forms in oversold condition

- It will be considered a best pattern if it forms during false breakout

- Formation of three inside up at key level (Support level)

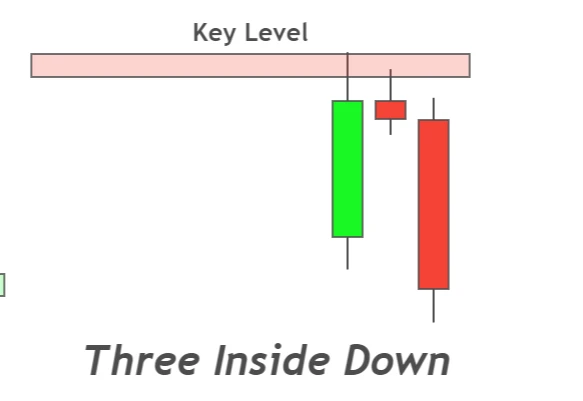

Three Inside down

The three inside down pattern indicates a bullish trend reversal, and it resembles the evening star pattern. The formation of the inside down pattern represents the end of the trend and the start of a new trend.

Three inside pattern consists of three candlesticks sequence wise.

- Big bullish candlestick

- Inside bar candlestick

- Big bearish candlestick

how to identify three inside down pattern

You must follow the following criteria before identifying a three inside the down pattern.

- Big bullish candlestick must have body ratio greater than 60%

- Size of inside bar candlestick should be small as compared to previous candlestick (optional)

- Big bearish candlestick must close below the low of previous bullish candlestick pattern

Conditions for a good three inside down pattern

A good three inside candlestick pattern should meet the following conditions

- It forms in overbought condition

- Usually form during false breakout

- At Key levels (resistance level)

Key fact of three inside up/down pattern

Technical patterns show us the activity of big traders/institutions. It also tells us that what is the next plan of big traders and how will they capture retail traders for their benefit.

This pattern tells retail traders that after a false breakout or stop loss hunting (big candlestick), an inside bar candlestick forms. Basically, the inside bar pattern shows that the market is in the decision phase and market makers are deciding their direction.

Breakout of the inside bar shows the future direction of market makers. Now after the breakout, the next candlestick will close above/below the high/low of the previous candlestick consecutively. Closing of candlestick above or below means price has broken the lower highs/higher lows by the formation of higher highs/lower lows.

So, there is a lot of things happening in just a single candlestick pattern. That’s why most traders prefer to use this pattern for technical analysis.

How to trade inside up/down pattern

There are a lot of strategies to trade inside up/down patterns in forex. But let me tell you a fact that you cannot use a single candlestick pattern as a trading strategy. Because I can easily make a trading bot based on candlestick patterns and let it run while sleeping. It will make me a millionaire within few months with a little effort. Is it? Not at all.

A trading strategy is a combination of many parameters and confluences. These parameters increase the winning probability of a trading strategy.

I will recommend you trade this pattern with your own method. But I will also recommend a strategy that can be used to trade this pattern. This will be an effective strategy and you can also modify by backtesting according to your temperament.

Trading strategy

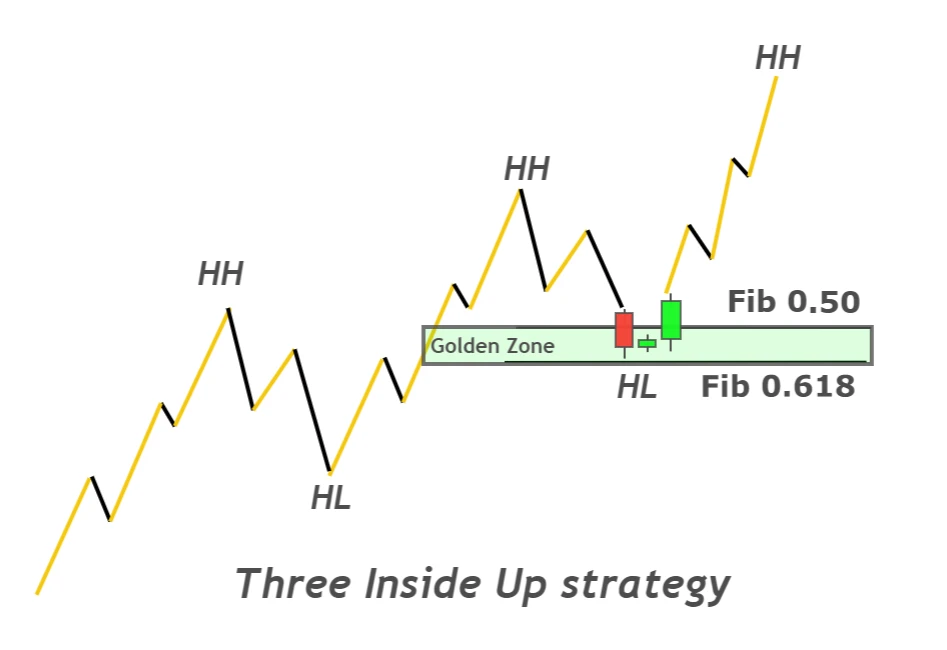

Three inside up/down strategy is based on the following three parameters

- Higher timeframe trend

- Fibonacci zone

- Three inside up/down pattern at key level

Follow the following steps

- Identify higher timeframe trend using higher high and lower low method or by using moving average

- Draw Fibonacci on last wave and highlight the golden zone (50-61.8%)

- Find out a Inside up/down pattern (in the direction of higher timeframe)

- Open a trade on the formation of candlestick pattern and place stop loss above/below the golden zone

- Take profit level will be at the origin of retracement wave.

This is a simple and profitable strategy. I will recommend trading this strategy on 15M or any timeframe above 15M. This will also work on lower timeframes but if you are in the learning phase, then you should prefer to trade on a higher timeframe only. Because trading on lower timeframes can make you psychologically weak.

If you don’t know about retracement waves, then make sure to read the article about the trend analysis (higher high and lower high)

Conclusion

Three inside up and three inside down are the best candlestick patterns. You must use these patterns to open a trade or to place a stop loss. These patterns help retail traders to get exact pinpoint entries and to increase risk reward ratio.