Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

ICT Order Block indicator Developed by ForexBee

The ICT Order Block Indicator, where “ICT” stands for “Inner Circle Trader”, is a tool that highlights significant price levels where institutions and big traders are likely placing their orders. These order blocks are essentially the “footprints” left behind by major players, signaling potential areas of interest for future price action.

In the realm of Forex trading, understanding where the big players are positioning themselves is crucial. This is where the ICT Order Block Indicator comes into play. It aids traders in identifying zones where large institutional orders are likely placed, providing an insight into potential future market moves.

How do we identify the Order blocks in trading?

There are two types of order blocks in trading based on the direction of the market.

- Bullish Order block

- Bearish Order block

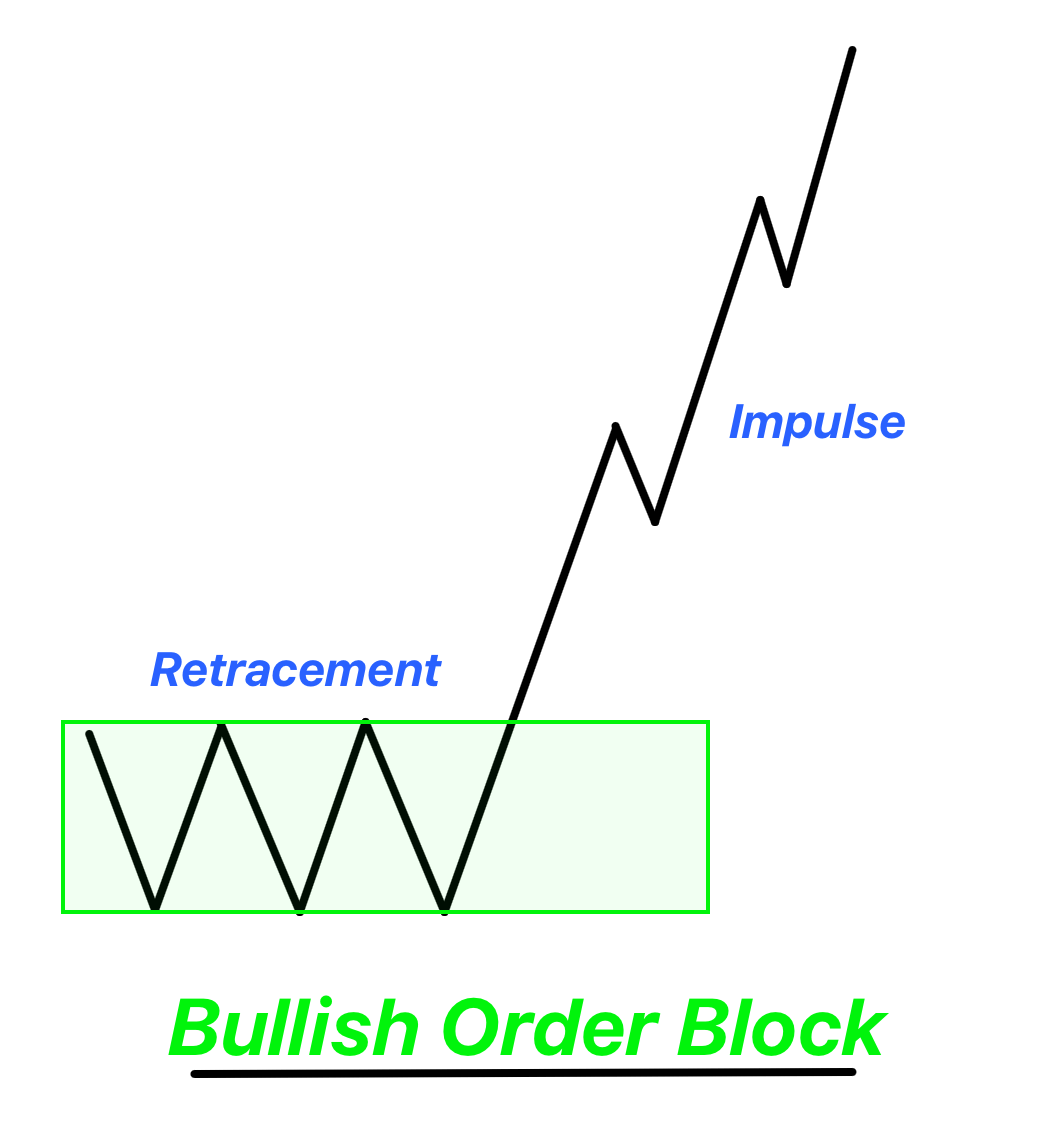

Bullish Order Block:

When prices move sideways for a while and then suddenly shoot up, we call this a bullish order block. This sudden move tells us that big players in the market, like banks or large investors, are starting to buy in that range. This range zone, where the buying starts, is important. It’s a hint of where the big money is acting, and that’s why it’s also called a bullish order block zone.

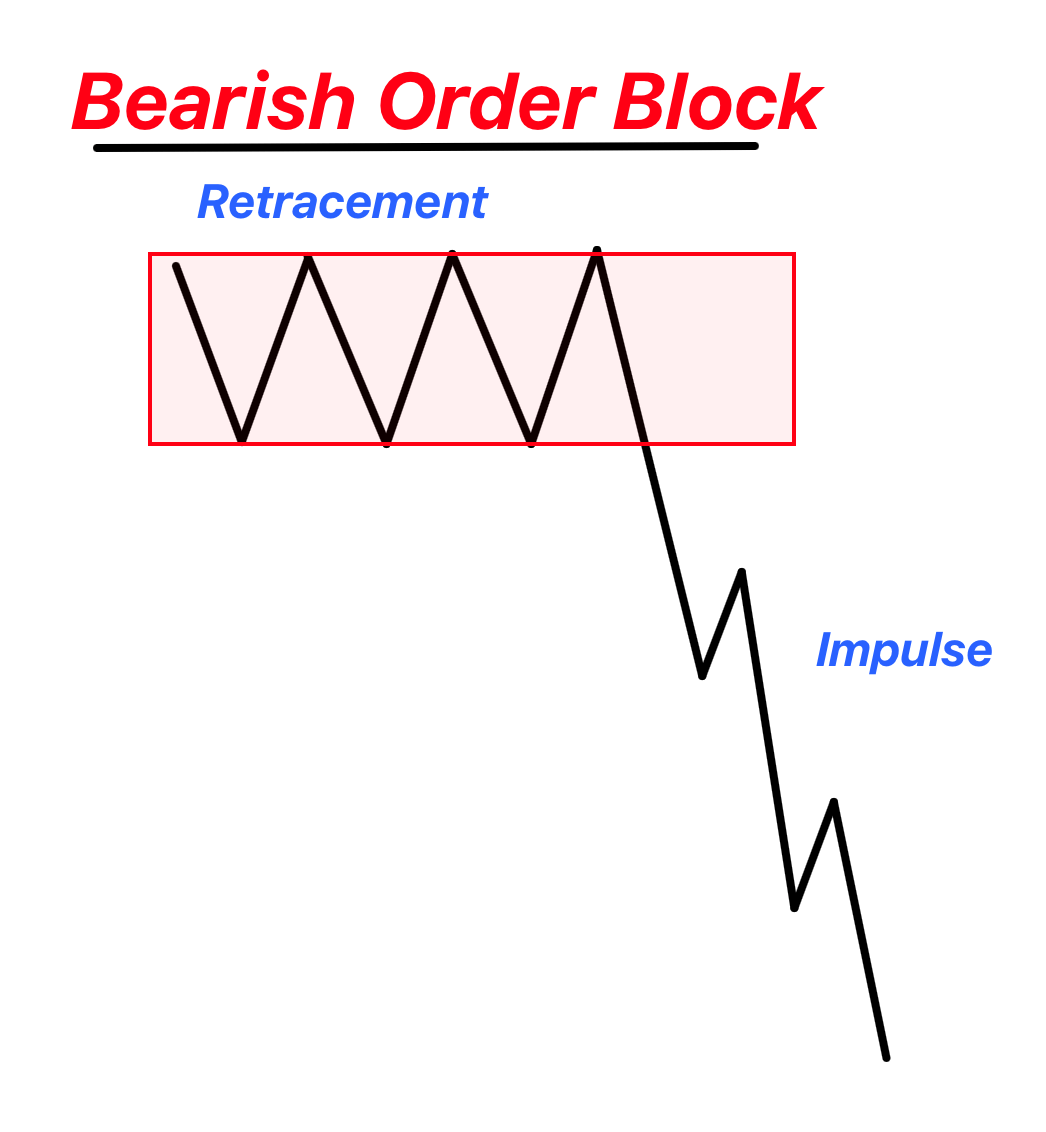

Bearish Order block:

A bearish order block forms after a period where the price is moving sideways, stuck within a specific range. When the price suddenly breaks down and out of this range, moving sharply lower, it indicates that large sellers, like institutional traders or banks, have placed significant sell orders at that range. This zone where the price was previously ranging becomes the bearish order block zone, showing where these market makers have likely positioned themselves to push the price downward.

Spotting an order block formation boils down to two crucial parameters:

Sideways Price Movement: The price remains in a tight range, moving sideways.

Impulsive Price Breakout: After the sideways consolidation, the price breaks free, giving way to substantial moves.

Importance of Order Blocks in Trading:

Imagine a quiet day at the beach. The water is calm, and everything is peaceful. But soon, the wind starts blowing, and big waves come crashing in. In trading, this peaceful beach is like the market when it’s not moving much, and the sudden waves are like order blocks.

Here’s why these “waves” or order blocks are so important:

- They Give Clues: Just like dark clouds tell us rain might come soon, order blocks can give traders a hint about big market moves that are about to happen. It’s like seeing where the big players in the market are making their moves.

- Safety First: If you see big waves at the beach, you’d be careful, right? In the same way, knowing where order blocks are can help traders protect their money. They can be more careful and make better decisions.

- Markets Move in Patterns: Just like the sea has calm times and wavy times, markets also have their quiet times and big move times. These patterns keep repeating, and understanding them can help traders do well.

- Make the Most of It: If you have a surfboard, big waves can be fun! Similarly, if traders spot order blocks early, they can use them to their advantage and make good profits.

So, just like understanding the sea can help you have a good day at the beach, understanding order blocks can help traders do well in the market. It’s all about spotting the signs and being ready.

How Does the Order Block Indicator Work?

The order block indicator is like a treasure map for traders. Even if you’re a part-time trader, this tool is invaluable because it pinpoints key zones for you, doing the heavy lifting.

Every trader’s dream is to spot the order block zones on their charts. Why? Because these zones give us clues about the next big moves of the market giants – the market makers. Being able to predict these moves allows us to set trades with a higher probability of success.

Remember the saying, “The trend is your friend”? It’s one of those golden rules in trading. Riding along with the market’s flow makes for smoother sailing. But many traders drift off course using tools that offer only rear-view insights.

Open buy and sell orders

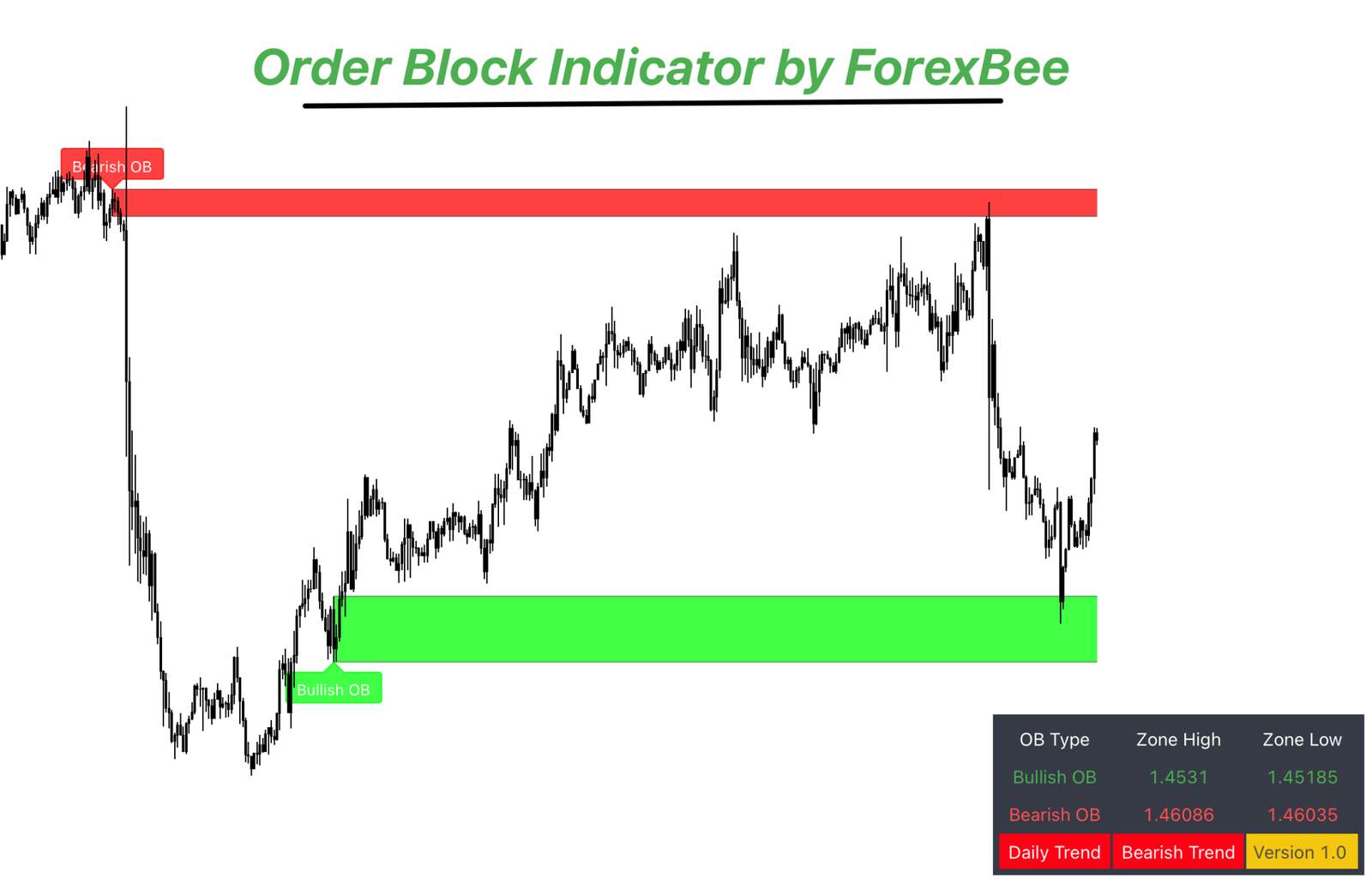

- Buy Order Block: This zone highlights where large buy orders, from institutions and big players, are located. It’s like a hotspot for buying, hinting that the market might be gearing up for a climb from the order block zone.

- Sell Order Block: Here, the zone indicates a concentration of significant sell orders. It’s a signal that there might be a downward shift in the market soon. You should look for sell opportunities from the bearish order block zone.

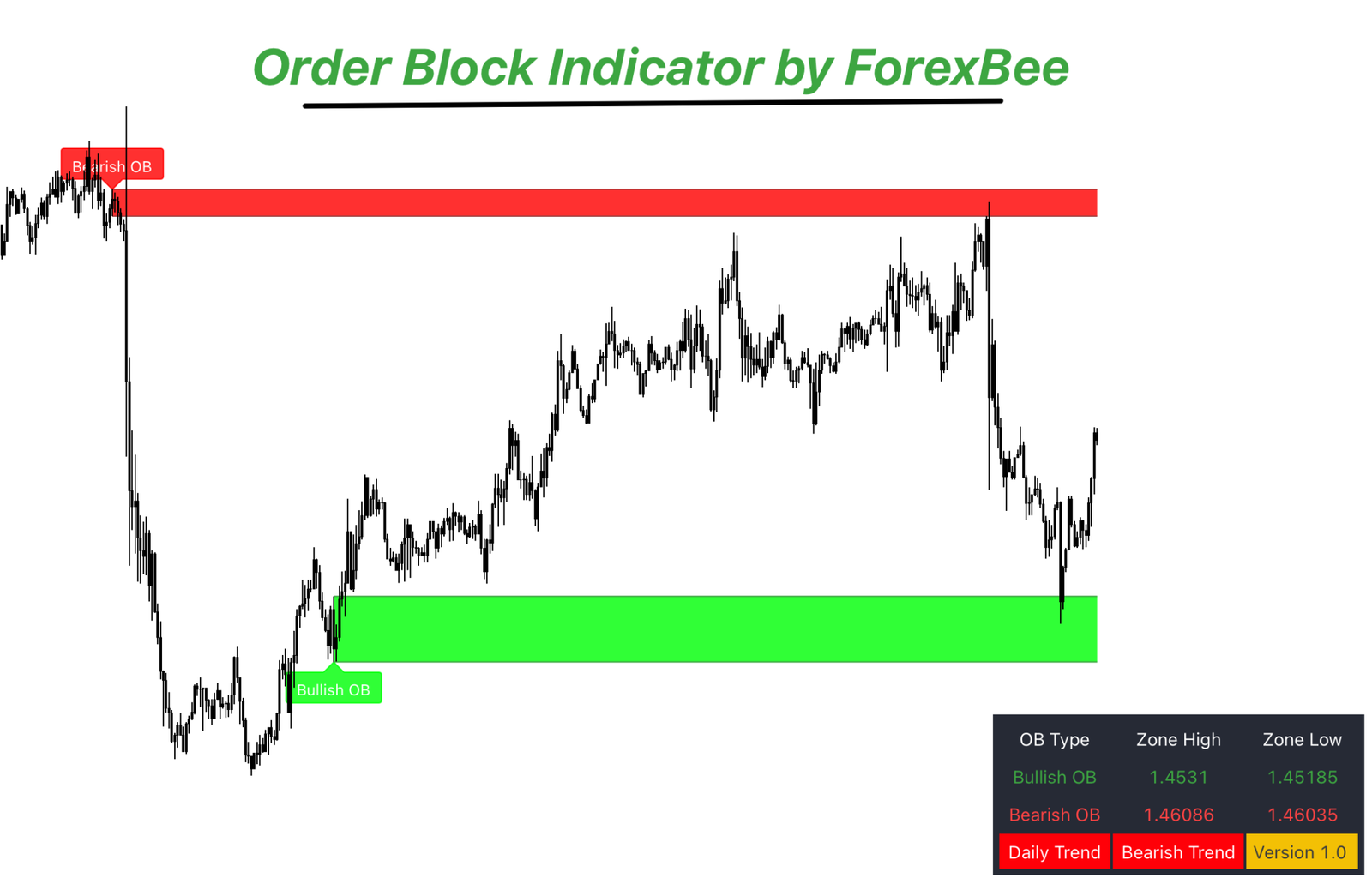

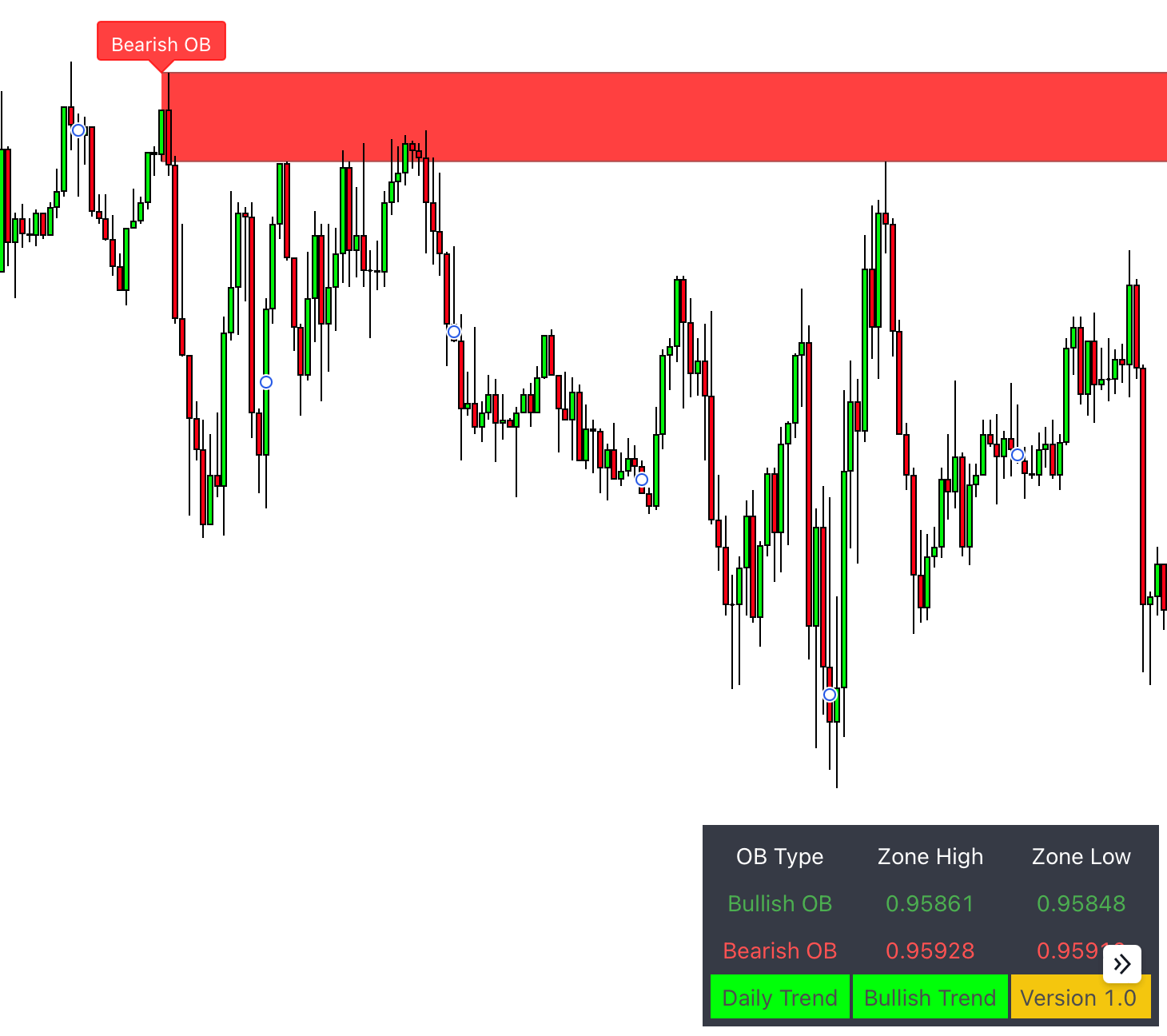

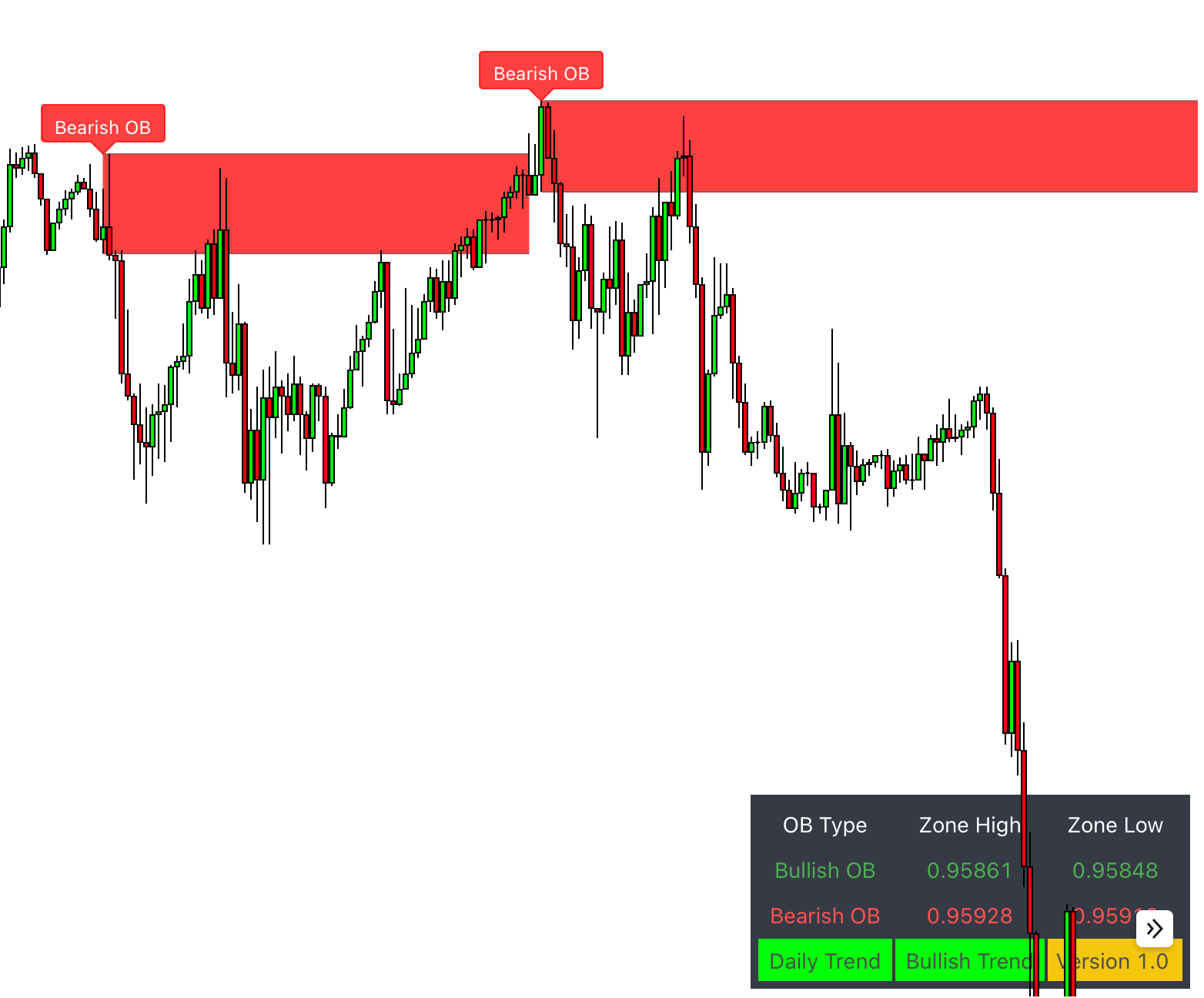

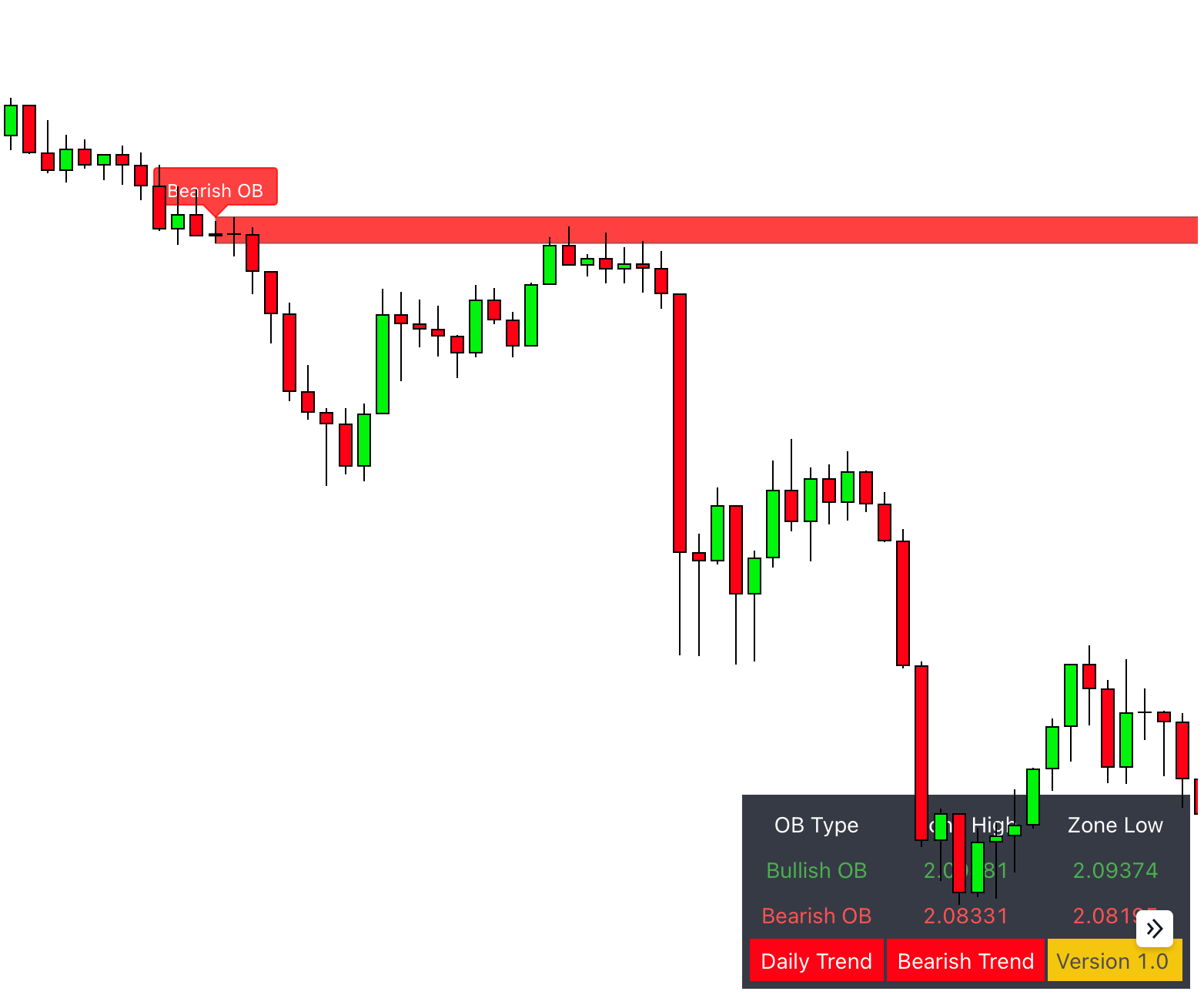

Here are the few trade examples using order block indicator:

Advantages of the Order Block Indicator

There are few pros of using this OB indicator that i have listed in the below table:

| Advantage | Description |

|---|---|

| High Probability Zones | Pinpoints zones where there’s a high concentration of orders, enhancing the likelihood of a profitable trade. |

| High Risk-Reward Trades | Allows traders to spot opportunities with a favorable risk-reward ratio. |

| Trend Prediction | Aids in forecasting the next significant market movement, enabling timely trade entries. |

| Incorporates Market Makers’ Activity | Aligns traders with the big moves made by large institutions, often leading to better trading results. |

| Perfect for Part-time Traders | Its clear signals and pinpointed zones suit those with limited time for trading. |

| Reduces Over-analysis | By focusing on specific high-probability zones, it curbs the tendency to overthink chart data. |

| Confluence Tool for Different Strategies | Complements and strengthens other trading strategies, giving a holistic approach to trading. |

Balancing Imbalances: The Nature of Order Blocks (for advanced traders)

One of the compelling features of order blocks, particularly for those who embrace a deeper understanding of market dynamics, is the concept of “imbalance.” Think of it as nature’s tendency to restore equilibrium.

When a sudden, powerful price movement breaks a range, it creates an area of imbalance on the chart. This is the region where the market experienced a disarray of sorts, with a notable gap between buying and selling pressures. This explosive movement is the market’s way of signaling a significant shift in the equilibrium between buyers and sellers. However, as with most things in nature, there’s an innate drive to return to balance.

Example of pendulum

Consider a pendulum that’s been pushed to one side; it will inevitably swing back to its resting position in its quest to achieve stability. Similarly, the price in the trading market often revisits these areas of imbalance or order blocks to “balance” out the previous disparity. It’s like filling a void left in its wake.

So, how does this insight benefit a trader? Recognizing these imbalance zones allows traders to anticipate potential price reversals or retracements. The price is highly likely to return to these zones, offering traders a chance to position themselves advantageously. Furthermore, when this understanding of imbalances is combined with other forecasting tools or strategies, it amplifies the potential for high-probability trades.

Remember, like nature strives for balance, markets too exhibit this innate tendency. Leveraging this insight can be a game-changer in your trading approach.

Conclusion

In the world of trading, understanding the dynamics of order blocks, particularly through the lens of the ICT Order Block Indicator, is a game-changer. These order blocks, representing a concentration of buy or sell orders, shed light on the actions of market makers. They give a clear view of when and where the big players are making their moves.

Moreover, the intrinsic connection between order blocks and market imbalances offers a unique vantage point for traders. The principle that nature, as well as markets, seeks balance means that price often revisits these imbalanced areas, creating high-probability trading zones.

The beauty of the ICT Order Block Indicator lies in its ability to pinpoint these high-probability zones and offer traders insights into market makers’ moves. It’s an invaluable tool for both novice and seasoned traders, simplifying the process and helping identify promising trade setups.

Our Order Block Indicator uses the idea of order blocks and market imbalances to help guide you through the markets. Improve your trades and make smarter choices by using this indicator now!

GBPUSD → A false breakout draws a pin bar. Sellers are winning 5/24/2024

GBPUSD → A false breakout draws a pin bar. Sellers are winning 5/24/2024