Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

Hidden Inside Bar Pattern

This article will cover everything in detail about an inside bar in forex technical analysis. Inside bar is not just a candlestick pattern there is a lot more to learn in its structure and to learn psychology behind it. If you want to be a professional trader then you must have the ability to see the patterns behind infinite timeframes. You should not stick to only 9 timeframes. The ability to observe the price reaction on bigger timeframes while watching smaller timeframes is owned by a professional forex trader only. Like in a school, only basics are taught but you have to figure out in-depth knowledge of basics by experience and hard work.

Inside Bar Candlestick

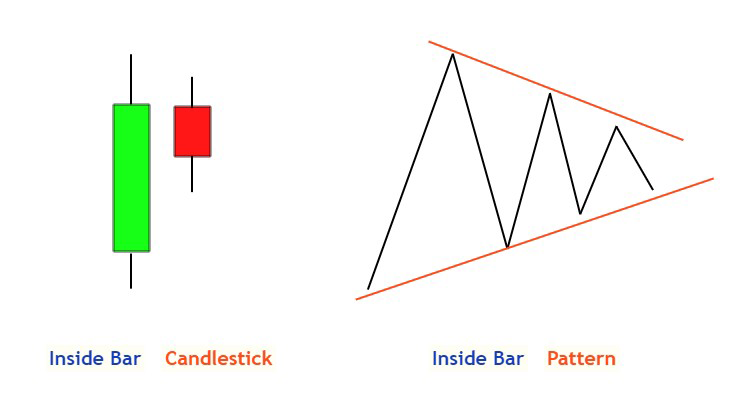

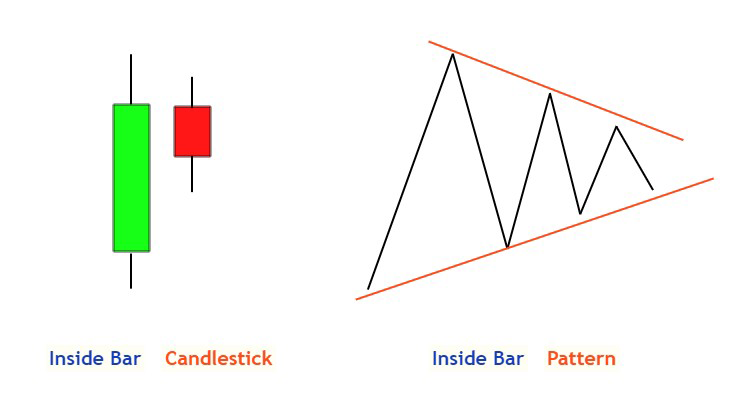

Inside bar candlestick pattern consists of two candlesticks. According to technical analysis rules, the First candle will be called a mother and the second one will be inside the range of the previous bar (mother candle). Watch in the chart below

But do you know about the psychology behind the inside bar pattern? Or do you know what happens when this candlestick pattern form? Or do you know about the pattern behind this inside bar pattern? Ask yourself

Now, the main thing is that if you know what’s going on during inside bar formation, then you don’t need to just wait for inside bar candlesticks on certainly available timeframes in mt4. Understanding the depth of a pattern is necessary for a better technical analysis.

Hidden Inside Bar Pattern

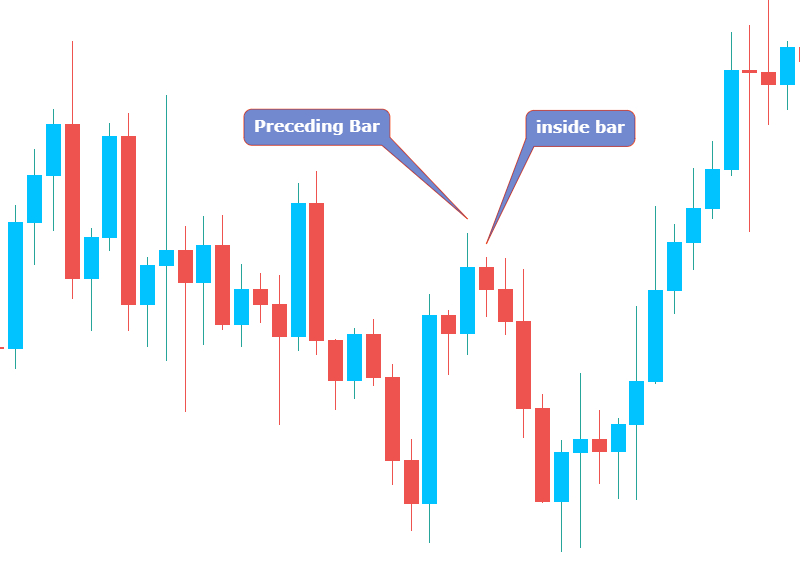

During inside bar pattern formation, price is looking for a direction. Decisions are being made by institutional traders. Like price has lost its direction and squeezing into a straight line but after the breakout of this pattern indicates a direction decided by the price. This is the psychology behind the inside bar pattern. The main purpose is to show all of you that for an inside bar pattern formation in the m15 timeframe will show that there must be an inside bar candlestick in the bigger timeframe it can be any timeframe like it can be a 5H timeframe or 6H and some minutes. I will call it hidden inside bars. The main thing is the structure by the price made repetitively.

Watch in the image below the view of inside bar candlestick formation and inside bar pattern formation for more understanding about it.

Usage of Inside Bar Pattern

This inside bar pattern technique can be used in a number of ways. It does not mean that you can only trade inside bar breakout. Instead, there are many other ways to use this pattern to increase the probability of forex analysis. Because there are many false breakouts to trap traders so we will not trade this breakout we will use it for our edge in technical analysis.

- Take profit level can be increased to increase Risk Reward ratio

- Stop-loss level can be reduced to increase the Risk-Reward ratio

- A confluence can be added to increase the probability of winning in a trade

Below is the live example of an inside bar pattern

and in Lower Timeframe

How to add it as a confluence?

Trading forex is game of probabilities. A trader can only increase the probability of winning in a trade. For example, you found inside bar candlestick in a daily timeframe. After the inside bar pattern breakout, price will progress in the direction of the breakout. We don’t have to trade this what will we have to do is to trade it in lower timeframes. Like on m5 or m15 timeframe, apply your specific strategy in the direction of breakout only. This is a confluence and it will increase your winning ratio a lot more. Less trades but winning ones.

The main focus of this article is to figure out the inside bar pattern. When an inside bar pattern will form in a certain timeframe then it means there is an inside bar candlestick in the higher timeframe. Now you will be able to figure out hidden inside bar candlesticks.