Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

Harmonic Patterns Cheat Sheet

Introduction to Harmonic patterns

Harmonic patterns are the geometric chart patterns that are made by using specific Fibonacci retracement and extension ratios to identify trend reversals in technical analysis trading.

These patterns were recognized by H.M. Gartley for the first time in history. Harmonic chart patterns are famous because of fixed Fibonacci ratios. Fibonacci is the best tool used to do technical analysis.

Each harmonic pattern is different, unique, and has a higher winning probability. but the main difficulty in trading harmonic patterns is to identify these patterns correctly on the chart.

List of all harmonic patterns

There are 9 harmonic patterns so far in the harmonic patterns cheat sheet that is used to predict the market.

- Gartley pattern

- Bat pattern

- Butterfly pattern

- Harmonic shark pattern

- AB=CD pattern

- 3-Drive pattern

- Crab & Deep Crab pattern

- 5-0 Harmonic pattern

- Cypher pattern

Gartley Harmonic pattern

Gartley is the most famous chart pattern among the harmonic patterns. It is a four-wave continuation chart pattern. It mainly depends on the retracement of price to 78.6% Fibonacci level either bullish or bearish.

Bat Harmonic pattern

Bat pattern is also a continuation chart pattern like the Gartley pattern. It is mainly the extension of the AB=CD pattern. It is formed on the chart during trend continuation. Due to rare occurrences on the price chart, it has a high winning probability because it predicts the direction of the trend only. That’s why it is easy to trade.

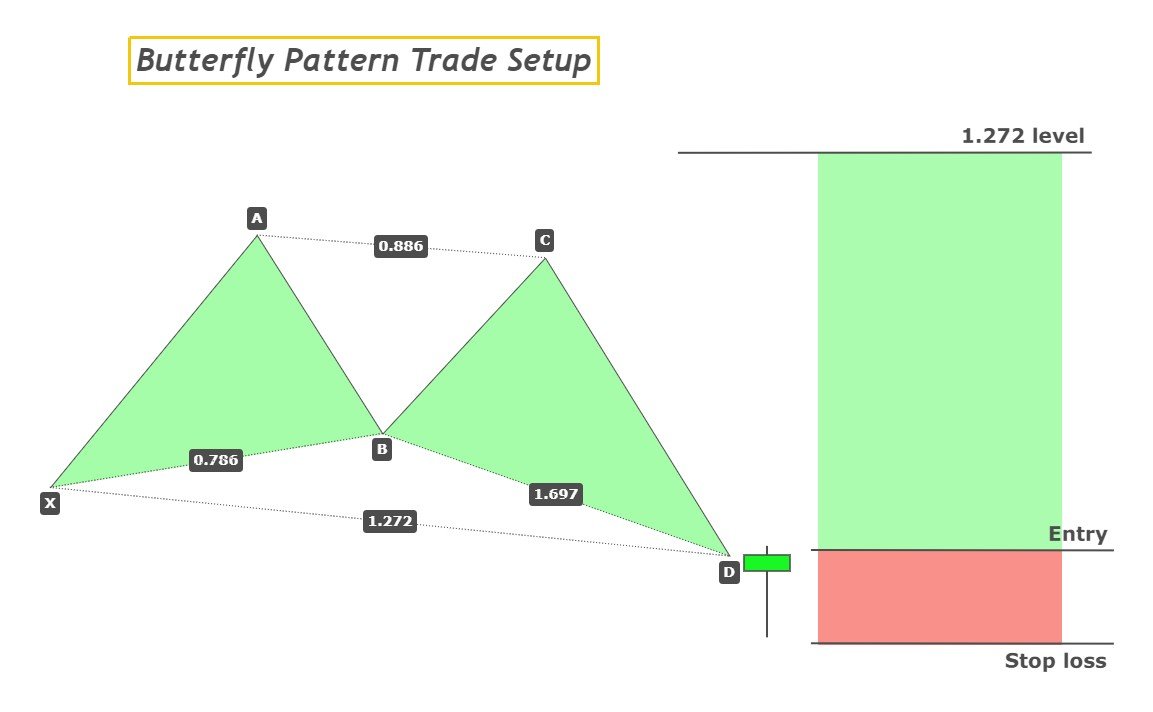

Butterfly Harmonic pattern

The butterfly is a four-wave reversal chart pattern. It is mostly formed during the end of the previous trend. Due to the reversal in the main trend, it is difficult to place a fixed stop loss in this pattern, but it offers a huge risk-reward ratio.

Bullish butterfly pattern forms at the bottom of the trend and bearish pattern forms at the top of the trend.

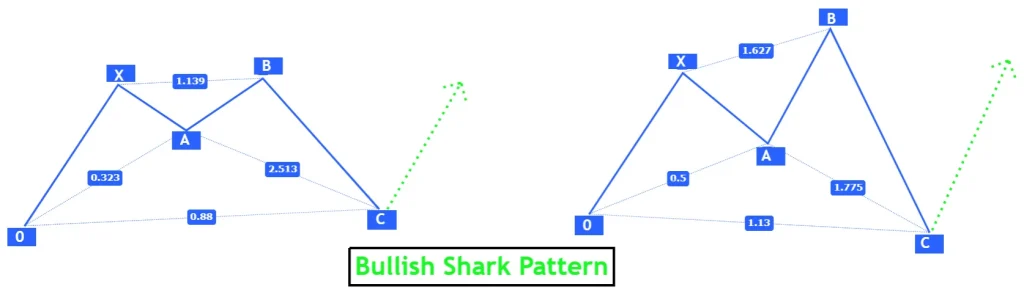

Harmonic Shark pattern

Harmonic shark pattern is a stop loss hunting pattern that’s why it is named a shark pattern. Price breaks highs and lows to eliminate the retail traders. Because big institutions don’t want retailer traders to profit. This method is used by big sharks of market.

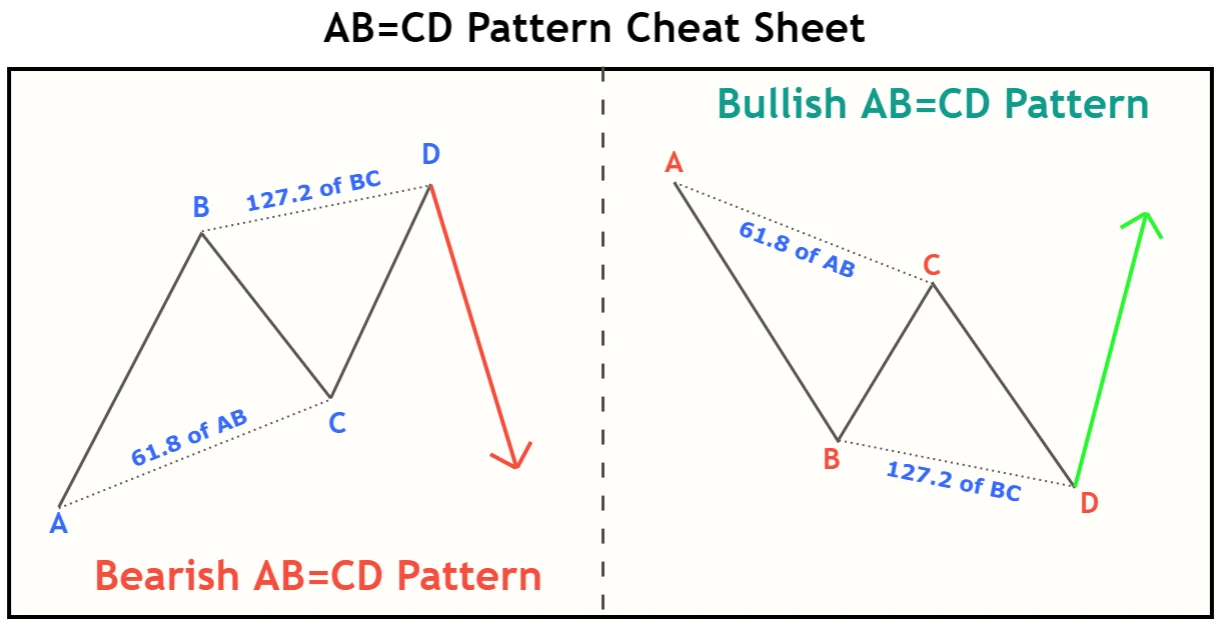

AB=CD Pattern

The most simplistic harmonic pattern is the AB=CD Pattern. It consists of two equal waves and represents a natural pattern. When this pattern forms then a reversal in price trend occurs.

It usually forms during price retracement. After retracement, an impulsive move starts.

Crab and Deep Crab Pattern

The crab and deep crab is a four-wave reversal Harmonic chart pattern. The main feature of this pattern is that it has the largest CD wave and deep retracement. As it is a reversal chart pattern, it offers a high risk-reward ratio.

5-0 harmonic pattern

As the name suggests it is a 5-point reversal Harmonic chart pattern. Unlike other harmonic patterns, the 5-0 pattern starts with the “0” point. It is a complicated chart pattern, but it has a high winning probability. By trading it with supply and demand will make the best trading strategy.

3-Drive pattern

The 3-drive pattern consists of three consecutive waves that indicate the three pushes by the market makers to break a certain level. it is a widely used harmonic chart pattern. It mostly forms at the end of the trend.

Download Harmonic Patterns PDF

In this PDF, we have attached images of harmonic patterns so you can use these images for backtesting purposes only.

Conclusion

Due to Fibonacci ratios, harmonic patterns have a high winning ratio. But you should always trade these patterns with confluence to filter out good trades.