This article is going to be very interesting for traders looking for price action strategies. Don’t confuse engulfing pattern with engulfing candle. The only difference between them is the difference in the timeframe. To master price action trading, learn the facts about the actions of price. Like what’s the fact behind the engulfing pattern? Most traders just know that after a bearish engulfing pattern, the price will go down. On the other hand, after bullish engulfing candle price will go up. But most of them don’t know about facts or go deep into engulfing pattern.

As a forex trader, I must say engulfing pattern is the origin of price action. Every price action pattern originates from engulfing pattern. At the end of this article, you will be able to understand how and why? Let’s start from basics to advance.

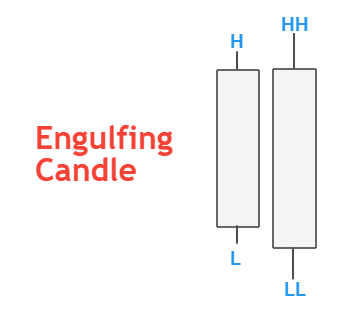

Engulfing candle

Engulfing candle refers to a candlestick that fully engulfs the previous candle. There are further two types of engulfing candles.

- Bullish engulfing

- Bearish engulfing

There are two rules of engulfing candles. Remember just engulfing the previous candle is not an engulfing pattern. It must completely engulf the previous candle including wicks.

- The high of engulfing candle must be higher than the previous candle

- Low of engulfing candle must be lower than the previous candle

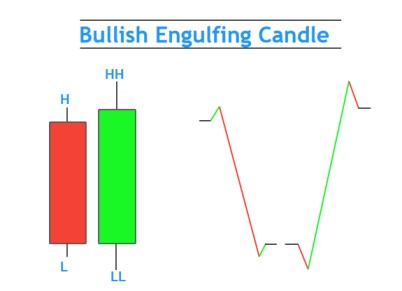

Bullish engulfing candle

A bullish engulfing candle represents a reversal of a bearish trend and the start of a bullish trend. It indicates that the forces of bulls have overcome the forces of bears and now the price will go up. Candlestick’s closing price will be higher than the opening price (green color) and make a higher high and lower low with reference to the previous candle.

To trade correctly engulfing candlestick is important. Engulf is to just make a higher high and lower low. But sometimes a Doji candle will also make a higher high and lower low. Here in this condition Doji candle also represents an engulfing candle but it is not a tradeable pattern. Because the Doji candle represents a pause in the trend. It doesn’t represent a change in trend.

There are two criteria’s to follow to trade only correct engulfing candlestick

- Body of engulfing candle only must be more than 75% of total candle size

- The location of the bullish engulfing candle must be at a swing high point.

Bullish Engulfing: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 2 |

| Prediction | Bullish trend reversal |

| Prior Trend | Bearish trend |

| Counter Pattern | bearish engulfing |

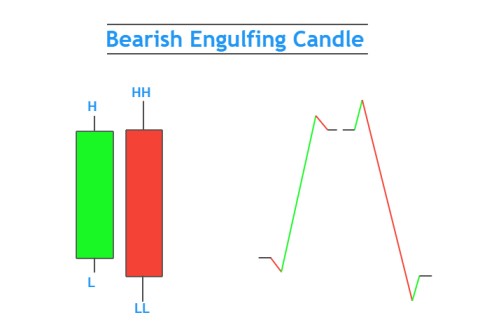

Bearish engulfing candle

The bearish engulfing candle represents the reversal of the bullish trend and the start of a bearish trend. It signifies that the forces of bears have overcome the forces of bulls and now the price will go down. Candlestick’s closing price will be lower than the opening price (Red color) and make a higher high and lower low with reference to the previous candle.

All the tips and tricks to trade only the correct engulfing candle will remain the same as discussed in the bullish engulfing candle section above.

Criteria for a profitable bearish engulfing candlestick is as follows

- Body of Bearish engulfing candle only must be more than 75% of total candle size

- Location of bearish engulfing candle must be at a swing low point.

Engulfing Pattern

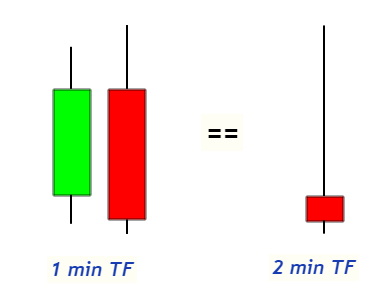

Engulfing pattern is the first and origin of price action in technical analysis. Every pattern is linked to engulfing pattern at some point in price action. There is engulfing pattern in every price action pattern. There is no need to switch timeframes. Only zoom out and look at the chart. Higher timeframe and lower timeframe can be analyzed from just a single timeframe.

What is engulfing in forex?

Engulfing means covering up completely. it means either buyers have completely covered up the forces of sellers and now the holder of the price is in the hand of buyers or the sellers have completely covered up the forces of buyers and now the holder of the price is in the hand of sellers.

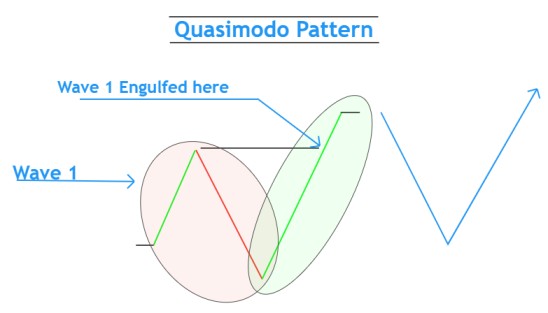

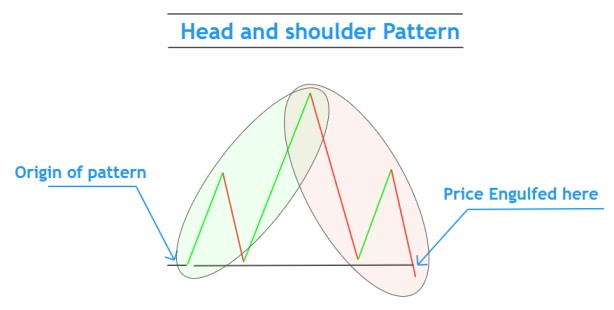

I will show you some patterns which originate from engulfing patterns. Like Quasimodo pattern, pin bar pattern, head and shoulder pattern, double top pattern, triple top pattern, and many more. For a better understanding, look at the images below.

In the Quasimodo pattern, the Green wave engulfs the red wave and indicates an upcoming reversal in trend.

Pin bar pattern also originates from engulfing pattern.

In the head and shoulder pattern, price first goes up and then comes down and engulfs the origin of price. This makes an engulfing pattern.

The same is the case for a double top, double bottom, and triple top triple bottom pattern.

This is the power of engulfing pattern and it is the most important pattern in price action trading.