Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

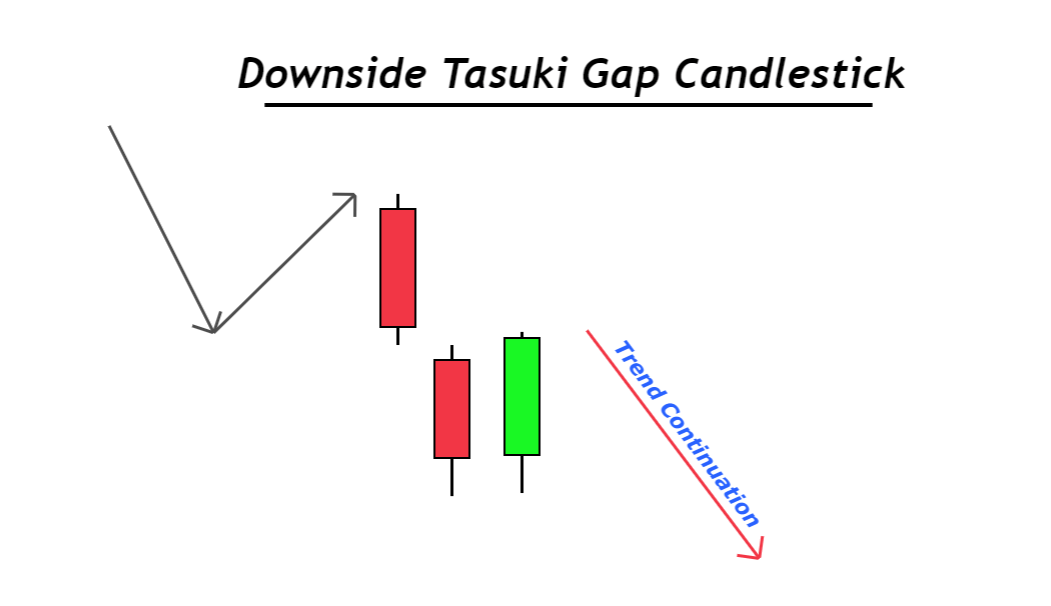

Downside Tasuki Gap Candlestick Pattern

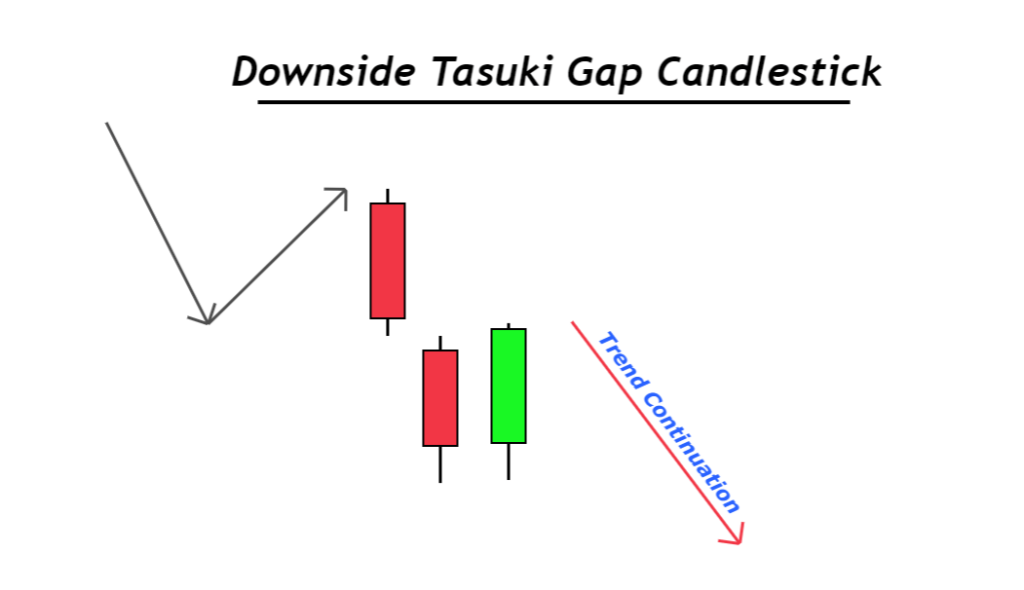

The Downside Tasuki gap is a continuation candlestick pattern that consists of three candlesticks with a downside gap. The downside gap will form within two bearish candlesticks.

It is a bearish trend continuation pattern representing the seller is in control. This pattern will usually form within a bearish trend. The continuation signal is the best signal for intraday traders to keep holding sell positions.

it is the opposite pattern to the upside Tasuki gap.

How to identify the Downside Tasuki Gap candlestick?

To find a Tasuki gap candlestick on the price chart, follow the following steps

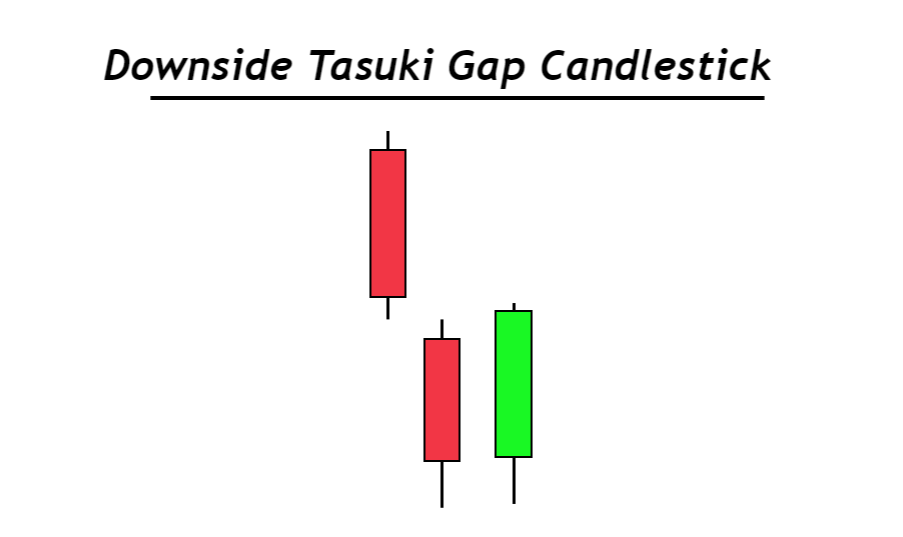

- The first candlestick should be a significant bearish candlestick that indicates the high momentum of sellers in the market.

- The second candlestick should open with a gap down, making a lower low. It will be a bearish candlestick, and the opening price should always be below the low of the first candlestick.

- The third candlestick will open within the range of the second candlestick, and it should close below the closing price of the first candlestick. It will be a bullish candlestick.

These are the simple criteria to find the downside Tasuki gap on the chart.

Downside Tasuki gap: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 3 |

| Prediction | Bearish trend continuation |

| Prior Trend | Bearish trend |

| Counter Pattern | Upside Tasuki gap |

The psychology behind the downside Tasuki gap pattern

When you read the price action behind this Tasulki gap pattern, you will know the activity of traders trading behind the chart.

The downside Tasuki gap pattern consists of two market patterns. The first is a bearish impulsive wave, and the second is a bullish price retracement. It is a bearish continuation pattern of supply and demand. It will form a drop base drop pattern

The two bearish candlesticks with a gap represent that the sellers are in complete control, continuously decreasing the price value. The primary trend is bearish, forming lower lows and lower highs. It is a bearish impulsive wave.

After this wave, a bullish retracement wave will start. During this session, buyers will try their best to increase the price, but they will fail, and the candlestick will close below the closing price of the first candlestick. Simply means, buyers fail to breach the resistance level created by sellers.

Pro Tip: A higher timeframe candlestick’s closing and the opening price will be the support and resistance levels on lower timeframes.

Best working conditions for downside Tasuki gap candlestick

You should follow specific requirements in trading to get the best results. Because every candlestick pattern is not going to work on the chart. So to filter out good patterns from the chart, you need to add confluences.

Here are a few confluences

- The downside of the Tasuki gap candlestick pattern should form in the bearish price trend.

- It should not be used for trading during overbought or oversold conditions

- A higher timeframe Tasuki gap pattern will form a big bearish trend on the lower timeframe. That’s why it can also be used for higher timeframe analysis.

Conclusion

This candlestick pattern will mostly form in the charts of stocks and indices. It will rarely form in forex. That’s why the daily timeframe Tasuki gap pattern will forecast a decrease in the stock value.

It would be best to always backtest this price pattern properly before trading on a live account.