Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

Descending Channel Pattern: A Forex Trader’s Guide

Definition

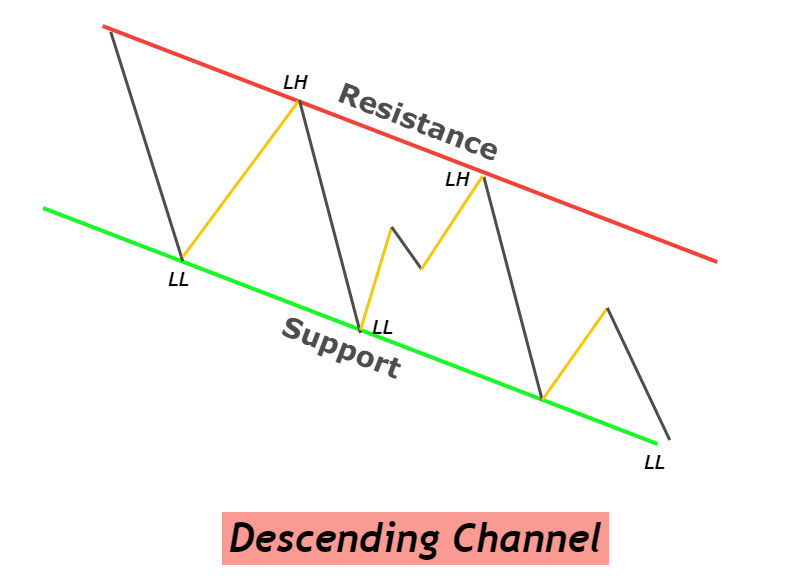

Descending Channel pattern is a type of channel in trading in which two parallel trendlines meeting the lower highs and lower lows of price make a bearish trend channel. This type of channel is used to identify the bearish price trend.

This price channel can be used as a bearish trend reversal and trend continuation channel pattern. It is the perfect method to trade in the direction of the trend.

How to identify descending Channel Patterns?

Descending Channel is directly proportional to the bearish price trend. A bearish trend means the formation of lower lows and lower highs on the price chart. So to identify a valid descending Channel pattern, follow the following steps

- The first step is to look for at least three lower lows on the price chart. Then draw a trendline meeting the three lower lows of price chart.

- Clone the first trendline and adjust it so that it meets the last lower highs made by price on chart.

- A descending trend channel will form. You should keep in mind that candlestick should not close outside the range of channel.

Pro Tip: A good descending Channel pattern will have more rejections of price from trendlines.

Is descending Channel a continuation or reversal pattern?

A descending Channel pattern acts as both a continuation and reversal chart pattern. It depends on some trading conditions.

For example, if you will trade within the channel and in the direction of channel trend then it will act as a continuation chart pattern.

On the other hand, if you will trade the channel breakout then it will act as a reversal chart pattern.

The most suitable method is trend continuation and within the channel pattern. Trading in the direction of trend filters many false breakouts. Also, another logic of trading within the channel is that, after channel breakout, instead of trend reversal price can also move sideways. That’s why you should trade in the direction of the channel.

How to trade descending Channel effectively?

The best way to trade channels is using higher timeframe analysis. Find a descending Channel on the higher timeframe and then trade in the direction of a bearish trend. It means trading lower timeframe channels within higher timeframe channels.

For example, draw a descending Channel on a higher timeframe like 1H, 4H, or daily TF. After drawing channel on higher timeframe correctly, now open lower timeframe and trade ascending channel reversal trading setup in the direction of the bearish trend.

Open a sell trade

After confirming descending Channel on a higher timeframe, draw an ascending channel on the lower timeframe. You should look for a breakout of ascending channels in a bearish direction with a big bearish candlestick. After the breakout, open a sell trade instantly.

Stop-loss level

Place stop-loss above the last high made by the price on the lower timeframe.

Take-profit level

The starting price of ascending channel pattern will be take-profit level 1. Now try to draw another descending Channel on the lower timeframe and keep on holding the trade until an opposite trendline breakout occurs. By following this method, the risk-reward ratio will increase.

Risk management

The minimum risk-reward ratio for descending Channel pattern is 1:1. If the RR ratio of any setup is less than 1:1 then you should wait for price pullback after a breakout.

Avoid false channel breakout

The best way to avoid false channel breakout is by adopting two methods. The first simplest method is to look for a big candlestick than the last 20-30 average candlesticks. The second method is to look at multiple timeframe channels. Trade channels in the direction of higher timeframe channels.

For example, if you figured a descending Channel on a daily timeframe then switch to a lower timeframe and look for ascending channel reversals or breakouts. So you can trade with a bearish trend.

Conclusion

Trading channels is a very effective technique to trade. These Channels are the most commonly used patterns by retail traders. That’s why it is necessary to add other confluences of price action patterns.

By combining channels with price patterns, the winning ratio of channels trading can also be increased.

GBPUSD → A false breakout draws a pin bar. Sellers are winning 5/24/2024

GBPUSD → A false breakout draws a pin bar. Sellers are winning 5/24/2024