Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

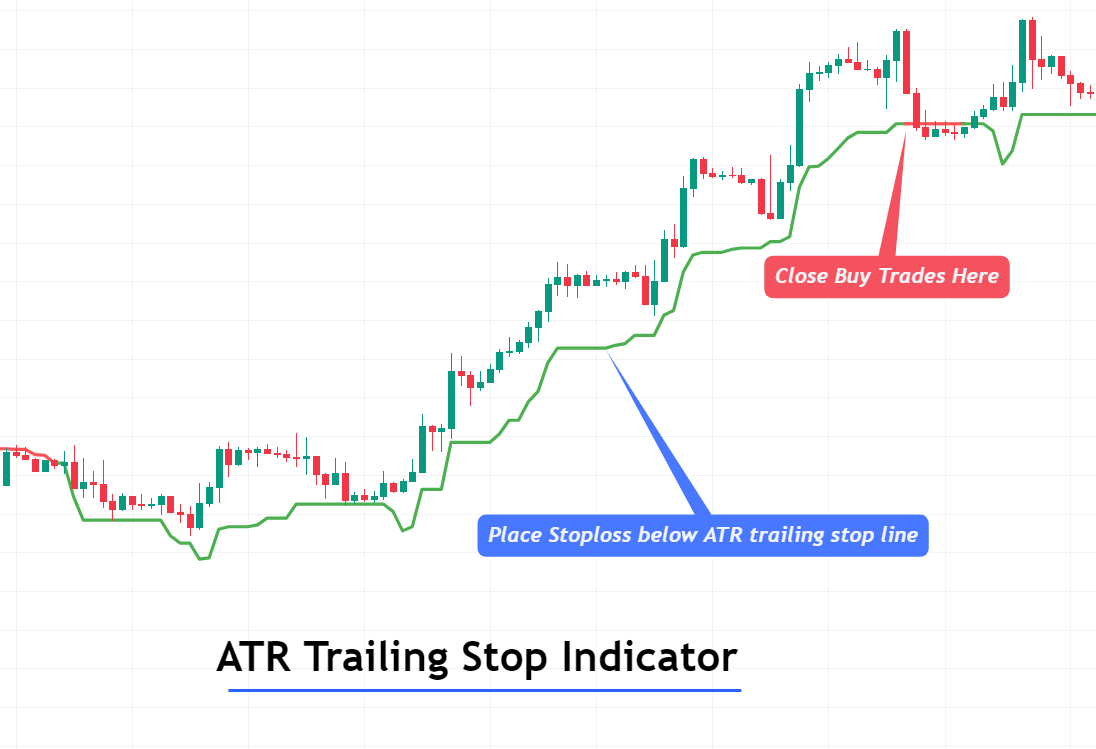

ATR Trailing Stop Indicator

Definition

ATR trailing stop is a technical indicator that determines the safe stop-loss levels for trades in technical analysis.

ATR means average true range and is the market’s degree of volatility during a specified time period. Instead of a fixed stop loss level, you can use the ATR trailing stop as a variable stop loss level. The ATR value will change according to the market conditions. So, this indicator will help you to use the stop loss level based on market conditions.

The volatility will be high in severe market conditions, and the trailing stop loss will widen. On the other hand, when there is low volatility in the market, the trailing stop will contract. So, I highly recommend using the ATR trailing stop indicator if you don’t know when to exit from a trade.

I will explain the ATR stop loss indicator in detail in this article, so make sure to read the full article.

Formula

ATR trailing stop formula consists of the following equations:

For uptrend: Previous close – (3*ATR)

For downtrend: Price + (3*ATR)

Here you should add the value of the average true range in place of ATR

The number 3 represents the multiplier, ranging from 2.5 to 3.5.

Calculations

The average true range is simply a moving average of the true range. The true range represents the difference between high and low, between previous close and low, or between high and previous close.

High – Low

Previous close – Low

High – Previous close

It will take the highest value from the above three calculations and then calculate the moving average. The resulting value will be the average true range value over a specified period.

Best settings for ATR trailing stop indicator

Here the time period for ATR trailing stop ranges from 5 to 21. Short-term traders usually use the 5 or 7 periods. However, long-term traders use the 21 period in this indicator.

| Inputs | Value |

|---|---|

| ATR Period | 14 |

| Multiplier | 3 |

How to trade with the ATR trailing stop indicator?

The ATR trailing stop indicator sets the stop loss levels of buy and sell trades in the market because it gives us the average true range of price that can be used to find a safe stop loss level.

This indicator will draw a line that will act as a trailing stop line. For a bullish trend, the trailing stop line forms below the candlesticks, while in a bearish trend, the line forms above the candlesticks.

Set the stop loss using ATR trailing stop indicator for buy trades

You should put the stoploss a few pips below the atr trailing stop line for buy trades. For example, if you open a buy trade on confirmation of a bullish pin bar candlestick, it is wise and safe to put stop loss below the atr trailing line instead of just below the low of the candlestick pattern.

Set stop loss for sell trades using the ATR trailing stop indicator

For sell trades, you must put the stop loss a few pips above the atr trailing stop loss line. For example, suppose you open a sell trade on confirmation of a bearish engulfing candlestick pattern. In that case, it is safe to put stop loss above the atr line instead of placing it just above the high of engulfing pattern.

Risk management

This is the most important factor that you must follow. Using the ATR trailing stop loss indicator, the stop loss size will vary from trade to trade. Because sometimes the market volatility will be low, and sometimes it will be high. Market conditions do not remain the same. That’s why you should calculate the lot size each time using the lot size calculator and invest fix amount of your capital on each trade (2%/trade for small accounts).

The bottom line

If you’re confused and don’t know where to profit from a specific trade, I highly recommend using the ATR trailing stop indicator.

I’m sure you’re not going to rely entirely on this indicator for trading, but you’ll use it to determine trade exit points.