Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

A Complete Guide to Rising Three Methods Candlestick

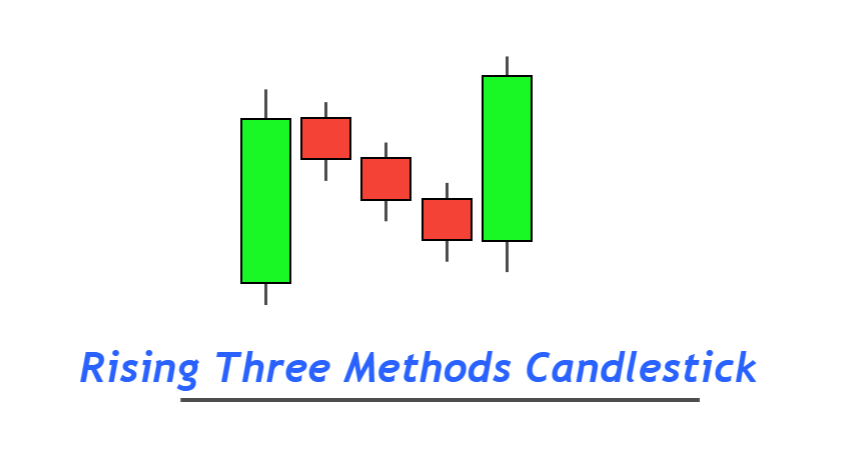

Rising three methods is a trend continuation candlestick pattern that consists of five candlesticks on the price chart. It forms during trending market conditions and indicates that price will continue.

Candlestick patterns have become an essential technical analysis tool that helps confirm or predict the direction of the trend. Rising three methods candlestick pattern helps a trader make critical trade management decisions like either holding a specific trade or closing that trade instantly. It will help you maximize profits and minimize the losses during trading.

How to identify rising three method candlestick?

The rising three method candlestick pattern consists of five candlesticks in a specific sequence. To find an ideal pattern on the price chart, follow the following rules.

- Rule 1: The first candlestick should be a big bullish candlestick having more than 60% body to wick ratio. It shows that buyers are in control.

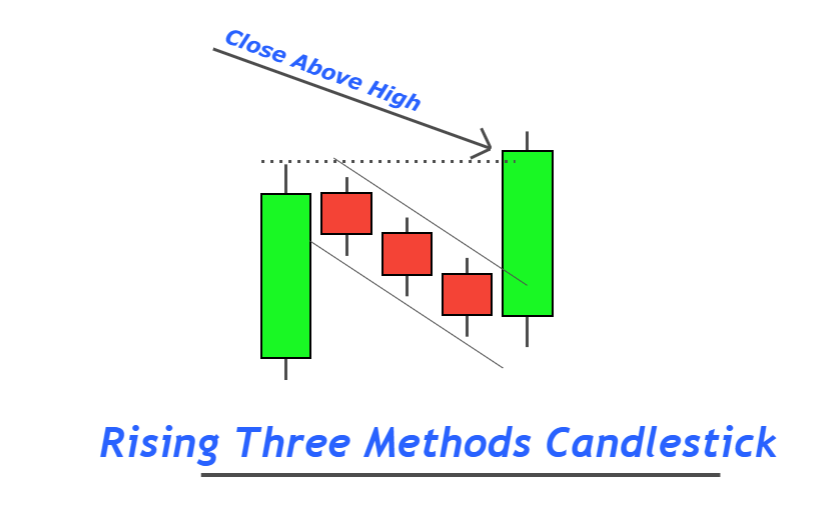

- Rules 2: After forming the bullish candlestick, three small bearish candlesticks should form above the low of the bullish candlestick. Remember that the fourth candlestick should not close below the low of the first bullish candlestick.

- Rule 3: Three bearish candlesticks should make lower lows & lower highs with a small body and large wicks/shadows.

- Rule 4: A big bullish candlestick with more than 60% body to wick ratio should form after three bearish candlesticks. It must break the highs of the previous four candlesticks.

These are the four rules you need to follow to detect a rising three methods pattern on the candlestick chart.

The bullish trend will continue after the formation of this pattern.

Rising three methods: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 5 |

| Prediction | Bullish trend continuation |

| Prior Trend | Bullish trend |

| Counter Pattern | Falling three methods |

What do the rising three methods candles tell traders?

There is sound logic behind the formation of this candlestick pattern. Before trading using any technical analysis tool, you should understand the sense of each tool. You should answer yourself as to why you are using a specific tool?

Let me explain the price action reading of the rising three methods candlestick.

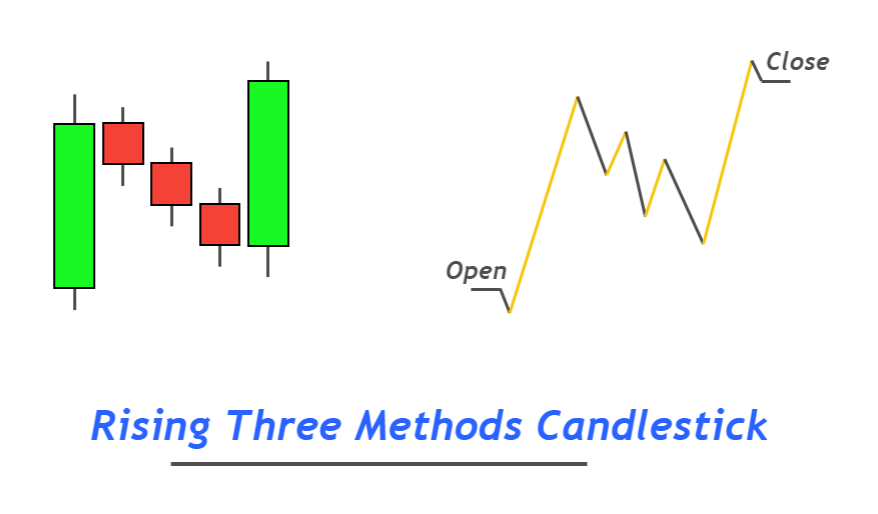

The first bullish candlestick in this pattern shows that the momentum of buyers is more significant than sellers. That’s why they are pushing the market in a bullish direction.

Three small candlesticks within the bullish candlestick territory show that sellers’ momentum is low. They cannot even break the low of bullish candlestick after three consecutive attempts.

The third bullish candlestick represents that buyers have overcome the forces of sellers by breaking the highs of the previous four candlesticks. This candlestick generates a signal of the rally in the upcoming market.

This is the market pattern within this candlestick.

How to trade rising three methods candle?

To trade using this candlestick pattern, you must specify the rules for trade opening, closing, and risk-reward ratios.

I will explain the best working conditions of this candlestick pattern.

Best working conditions

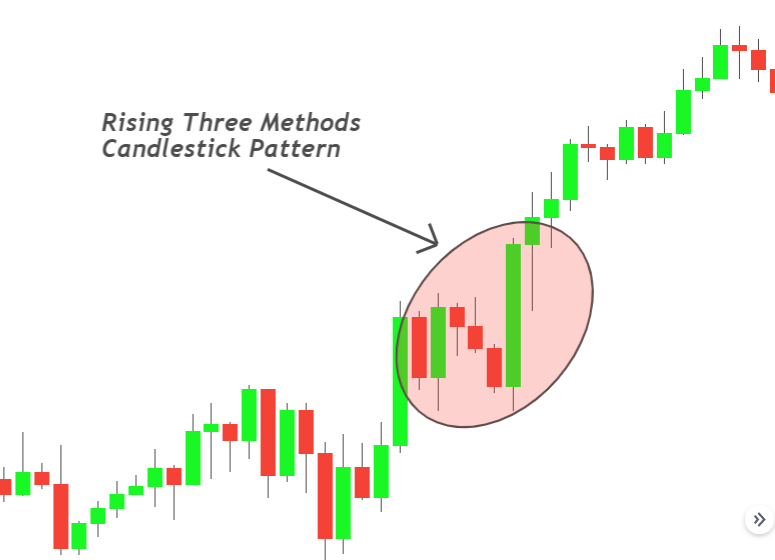

- Rising three methods candlesticks will work during the middle of the trend.

- Avoid the candlestick patterns that form at the reversal points, like resistance zones.

- Do not trade this candlestick pattern during overbought conditions

Trading strategy

After confirmation of rising three methods candle, place a buy trade and adjust stop loss below the low of the first bullish candlestick. Take profit level is adjusted by using the Fibonacci tool. 1.618 & 2.618 levels can be used as take-profit levels.

The bottom line

The best way to use a candlestick is for trade confirmation. The beauty of rising three methods candlestick is that you can also use it to extend take profit levels of any previous trade. For example, if you were holding a bullish trade and a rising three method candlestick form, you should try to hold trade longer to get maximum profits with a high-risk reward.

Make sure to backtest the trading strategy before trading on a live account.