Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

A Complete Guide to Bearish Abandoned Baby Candlestick

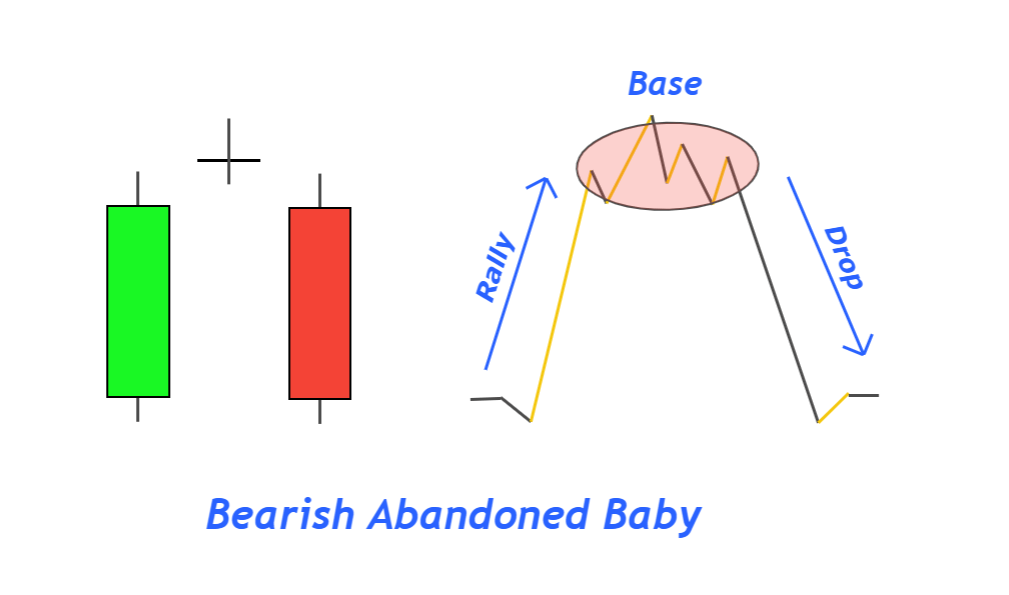

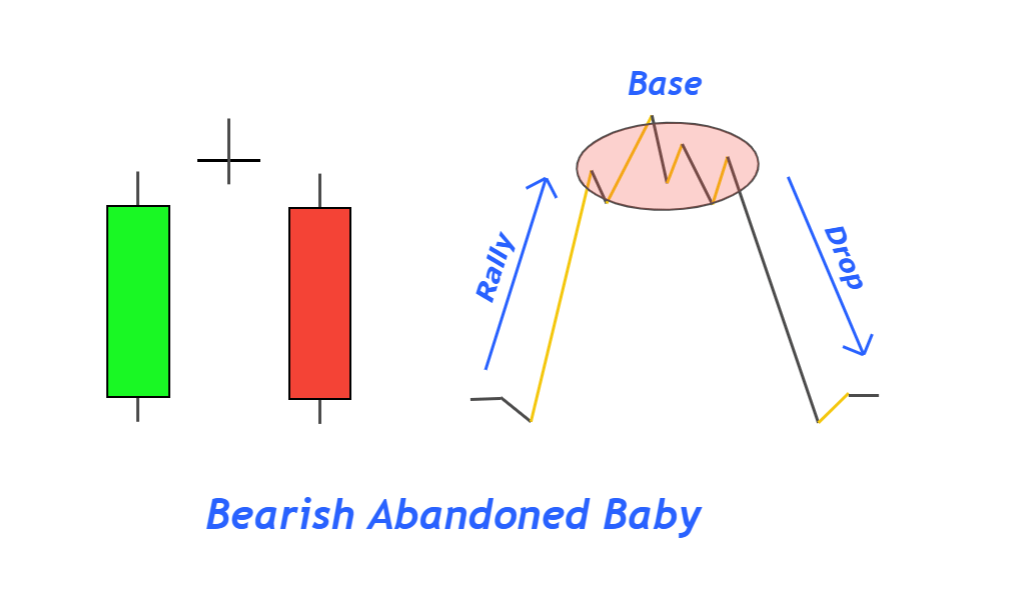

A bearish abandoned baby is a trend reversal candlestick pattern made up of a bearish candlestick, a bullish candlestick, and a Doji. A gap forms before and after the Doji candlestick, and Doji candlestick forms between bearish and bullish candlestick.

More than one Doji candlesticks in an abandoned baby pattern can also form between bullish and bearish candlestick. There is complete psychology behind this pattern. Because the first candlestick will increase the price, the second/Doji candlestick will hold the price, and the third candlestick will decrease the market price. It is indirectly related to the rally base drop pattern.

How to identify a bearish abandoned baby?

You need to follow a few guidelines to identify and refine a perfect candlestick pattern on the price chart. Follow the following rules.

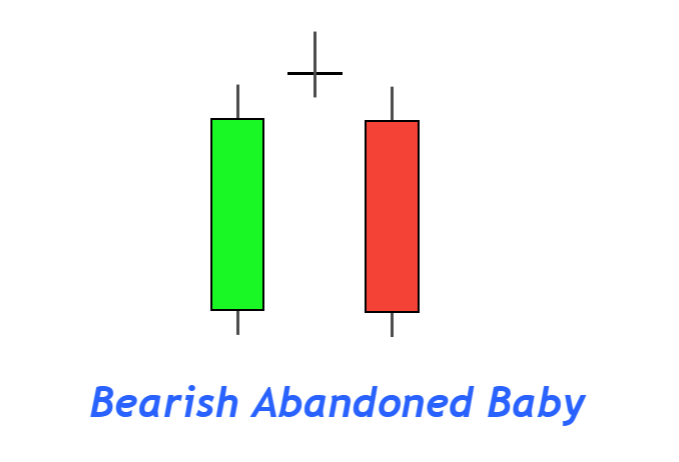

- Bullish candlestick: it should have a big body (at least 60% body to wick ratio) and small shadows/wicks because it will represent a rally in price trend.

- Doji candlestick: it will form after bullish candlestick and must have large wicks (body to wick ratio less than 25%). More than one Doji candlestick can also develop, but it should meet the criteria.

- Bearish candlestick: it should also have a large body with at least a 60% body to wick ratio.

Pro tip: The closing price of bearish candlestick matters a lot in a price trend reversal. It should always close below to 50% level of the bullish candlestick. In an excellent bearish abandoned baby pattern, the bearish candlestick will have a closing price below the low of the bullish candlestick.

Bearish abandoned baby: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 3 |

| Prediction | Bearish trend reversal |

| Prior Trend | Bullish trend |

| Counter Pattern | bullish abandoned baby |

Technical analysis of abandoned baby pattern

By price reading of this candlestick pattern, you will know that it is related to the rally base drop pattern.

I will explain how the price will change the bearish abandoned baby pattern trend.

- Rally: bullish candlestick represents a rally in price because it has a low opening and higher closing price. The momentum of buyers is more remarkable than sellers, and buyers are pushing the price in the bullish direction.

- Base: After the rally, the price trend will pause here because the Doji candlestick represents indecision in the market. Price will move sideways.

- Drop: A big bearish candlestick will form after Doji indicating a significant decrease in price from a critical level.

So, this term is directly related to supply and demand in technical analysis. It creates supply. That’s why it gives a trend reversal from resistance or supply zone.

Best working conditions for bearish abandoned baby candle

Three conditions will increase the probability of trend reversal. You can also add your technical tools for this purpose.

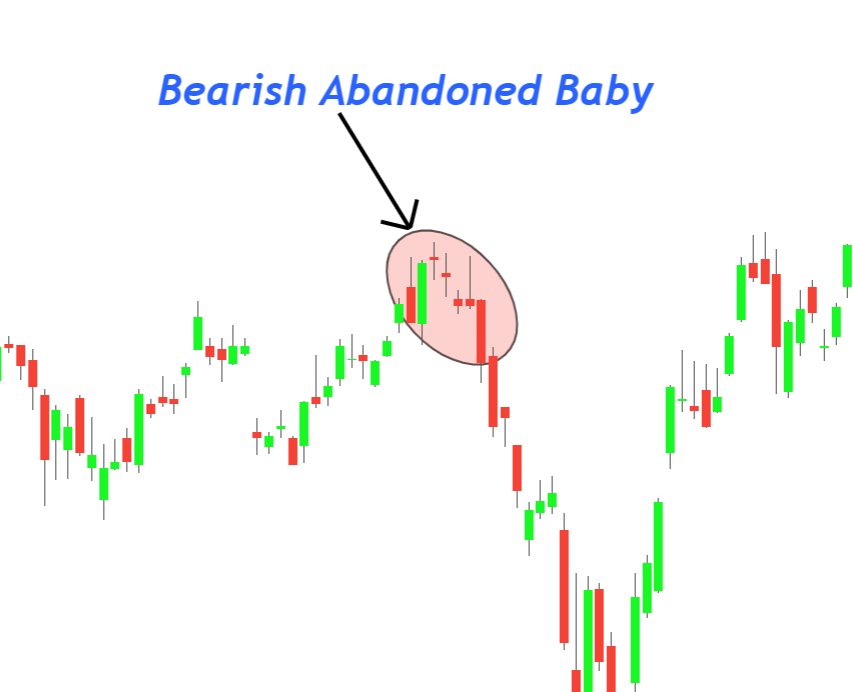

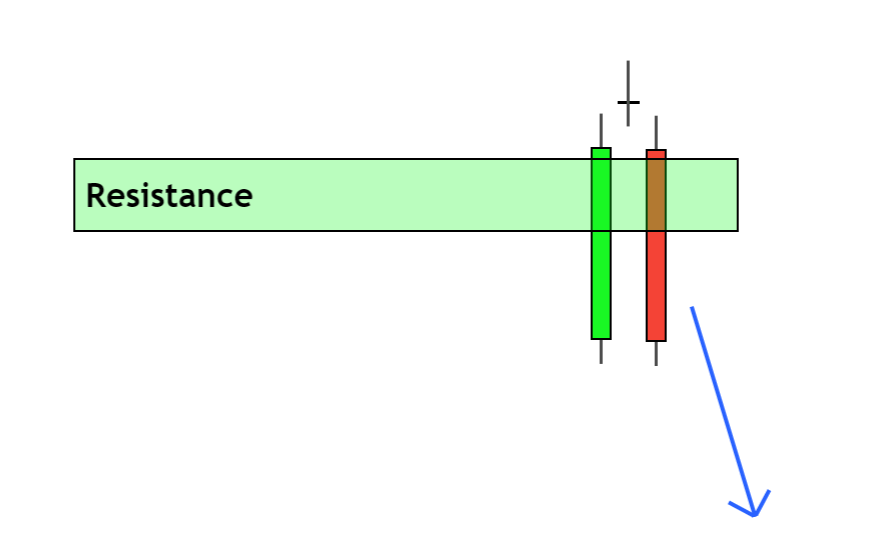

- This pattern should form at resistance or supply zone on the chart.

- It should give a false breakout above the key level. (optional)

- Overbought conditions will also add power to this trading pattern

Difference between evening Doji star and bearish abandoned baby candlestick

There are two significant differences between these two candlestick patterns

- Gap up: in the bearish abandoned baby candlestick, Doji candlestick has high opening and closing price than bearish and bullish candlesticks. It forms with a gap. But in the evening Doji star, the gap is not present between doji and other candlesticks

- More than one doji: abandoned baby candlestick pattern can have more than one doji candlestick, but an evening doji star will only have one doji candle.

Conclusion

Both evening doji star and abandoned baby are bearish trend reversal candlestick patterns. But due to strict requirements, bearish abandoned baby patterns have a low signals rate in forex trading. That’s why it is advised to trade this pattern in stocks and indices.

However, you can use this pattern for technical analysis purposes on higher timeframes to forecast the trend reversal.