Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

A Complete Guide to Evening Doji Star Candlestick

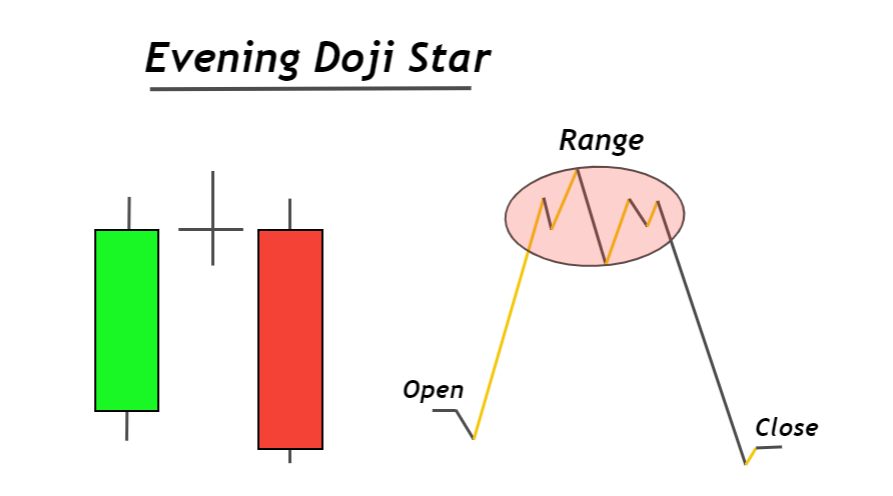

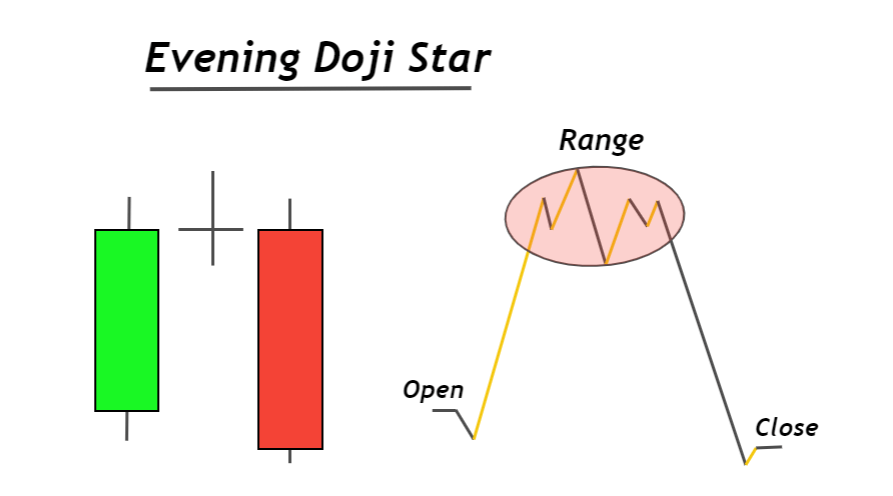

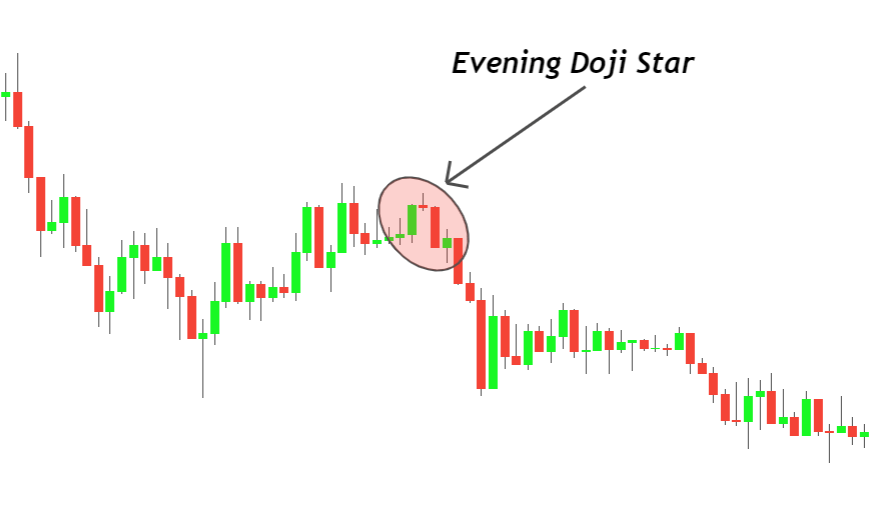

Evening Doji Star is a three-candlestick pattern made up of a bullish candlestick, a Doji candle, and a bearish candlestick in series. It is a bullish trend reversal candlestick pattern.

Candlestick patterns trading is a popular method of technical analysis in forex trading. It helps to identify the best price trend reversal levels on the chart. A price pattern represents the activity of traders on the price chart, and candlestick patterns are the best examples of many price patterns.

How to identify the evening Doji star?

On the chart, three candlesticks (bullish candle, Doji candle, and bearish candle) combine to make an evening Doji star candlestick. To find an ideal evening Doji star pattern on the chart, follow the following rules.

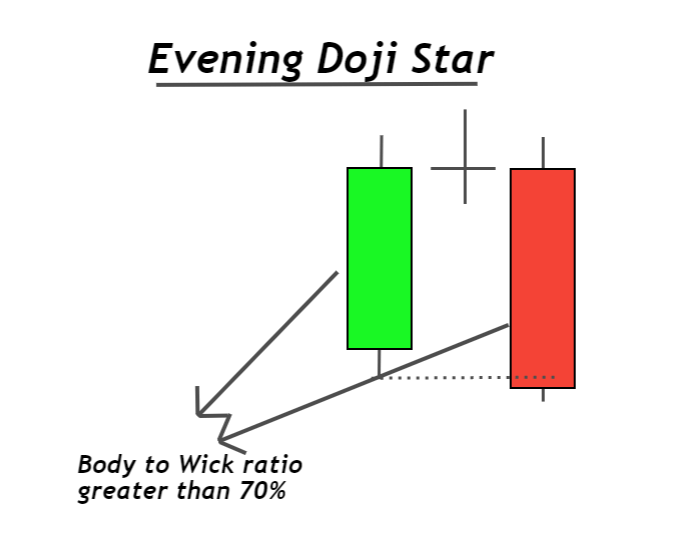

- Rule 1: The body-to-wick ratio of the bullish and bearish candlestick should be more excellent than 70%. Because it shows the momentum of buyers in the market, at the same time, the wick/shadow of the candlestick indicates indecision in the market.

- Rule 2: Doji candlestick should open above the closing price of the bullish candlestick. In forex, the chances of the gap on a higher timeframe are significantly less. That’s why a gap is not necessary for forex currencies. But Doji candle must have the same opening & closing price.

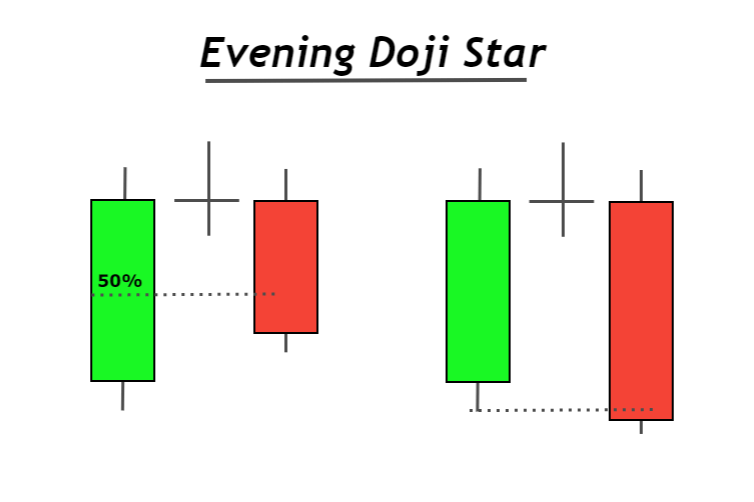

- Rule 3: The bearish candlestick must close below the 50% level of the bullish candlestick.

The third rule is mandatory to follow. A strong sell signal forms when the price closes below the low of bullish candlestick because it represents that sellers have engulfed the buyers, and now sellers are stronger than buyers.

Evening Doji star: Information Table

| Features | Explanation |

|---|---|

| Number of Candlesticks | 3 |

| Prediction | Bearish trend reversal |

| Prior Trend | Bullish trend |

| Counter Pattern | Morning Doji star |

What does the evening Doji star tell traders?

There is a complete story of traders behind this candlestick pattern. I will explain in detail to make you able to read the price.

Storytime…

Read below to learn price action reading…

The bullish candlestick on the chart shows that buyers are buying a specific asset stronger than sellers. That’s why the price is moving upward. But a candlestick with a big body than average represents a break of a critical level/resistance level. When the price breaks a resistance level of a currency pair, retail traders will buy that currency pair.

Doji candlestick after bullish momentum indicates a pause in a bullish trend. It means market makers are deciding the direction of the market.

Retail buyers have placed buy orders after key resistance level breakout, but the price closed below the resistance level again. Now prices will go down, and retail buyers will face losses. That’s why the evening Doji star also acts as a false breakout candlestick pattern.

What are the best working conditions for Evening Doji star?

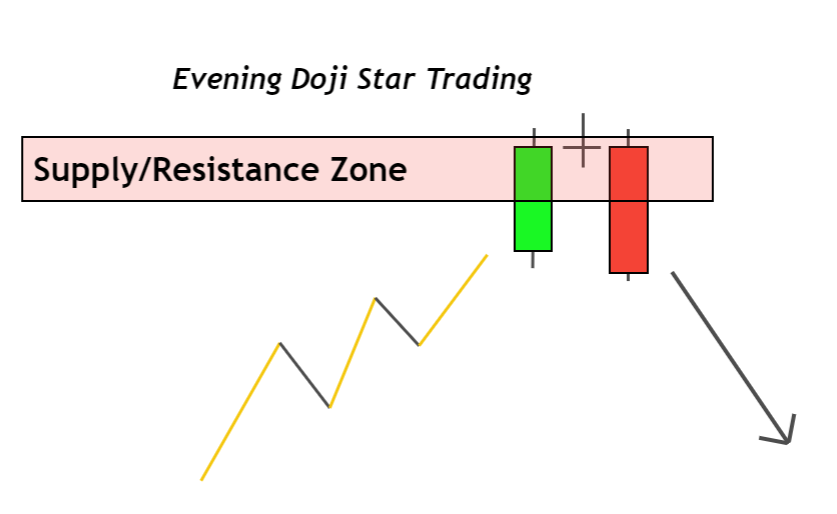

A single evening Doji star cannot reverse the whole trend of the market. So, to make it a powerful candlestick pattern, you will have to add other technical confluences, for example, resistance or supply zone.

- Resistance Zone: Price always reverses from the resistance zone. There is a strong probability of bullish trend reversal from the resistance level. But if we add resistance level with the candlestick, then the possibility of a trend reversal will increase.

- Supply Zone: In trading, the supply zone contains pending sell orders of big institutions. That’s why the price trend will mostly reverse from the supply zone, but if we add a confluence of the supply zone with the candlestick pattern, then the probability of trend reversal will increase.

These are the two best working conditions for this candlestick pattern. You can also add other confluences like overbought or trendline confirmation.

Difference between Evening star and Evening Doji star pattern

These two candlestick patterns have almost the same structure; only the middle candlestick makes a difference between them.

- Evening star candlestick has a small spinning top

- Evening Doji star has a small Doji candlestick

Pro Tip: An Evening Doji star pattern will be more powerful if the closing price of the bearish candlestick is below the low of the bullish candlestick.

The Bottom Line

To confirm a trend reversal in technical analysis, candlestick patterns work best. In trading, to make a perfect strategy, you always must add confluences to increase the winning probability.

Morning Doji Star is the opposite candlestick pattern of evening Doji star. I have explained a simple trading strategy of the morning Doji star, which can also be applied to the evening Doji star.