Education Hub

Candlesstick Patterns

Chart Patterns

Forex Analysis

Forex Education

Best Bollinger Bands Settings For Trading

Bollinger Bands is a technical analysis tool invented by John Bollinger to forecast the market using moving averages & standard deviation.

It’s purely based on mathematical concepts and is a widely used tool among retail traders.

If you don’t know the basics of the Bollinger bands tool, I highly recommend you read this article before reading this for better understanding.

In this article, you’ll learn about the best settings for the Bollinger bands indicator on intraday, scalping, and swing trading.

What are the Bollinger bands?

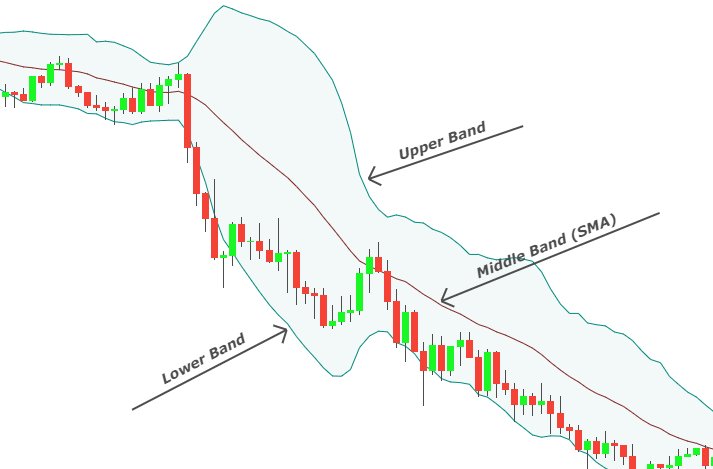

Bollinger bands consist of three bands.

- Upper band

- Middle band

- Lower band

The middle band is a simple moving average. Moving average line plots the average closing value of the last specific number of candlesticks. It also acts as dynamic support or dynamic resistance line.

The upper and lower band is the standard deviation of the moving average line. Standard deviation is the deviation of the price from the mean value. Because moving average line always attracts the price. Price always comes back to test the moving average line.

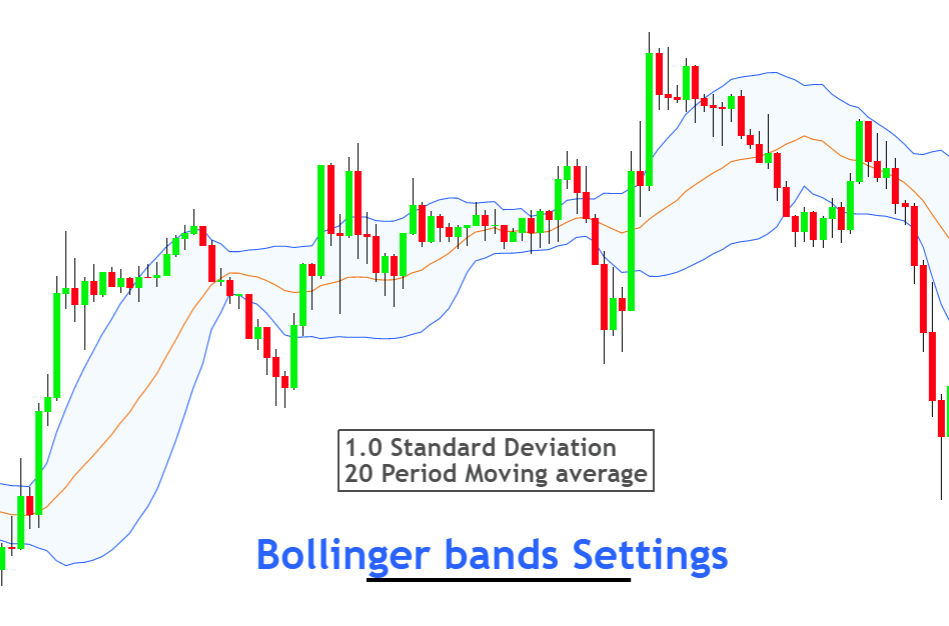

Which standard deviation value is the best in BBs?

As standard deviation is the price deviation from the moving average line, its value will be low in scalping and high in position trading. Because scalping is the fastest type of trading and position trading is the slowest type.

According to research,

- With a 1.0 standard deviation, 65% of the price action happens within the Bollinger bands

- With a 2.0 standard deviation, 95% of the price action happens within bands

- In 3.0 standard deviation, 99% of the price action happens within bands

Optimal settings for Bollinger bands

The settings of Bollinger bands depend on the type of trading. For example, for intraday trading, Bollinger bands’ settings will be different compared to swing trading. If you are using the same settings for all types of trading, you are misusing it.

There are four major types of trading

- Scalping

- Intraday trading

- Swing trading

- Position trading

For each type of trading, there are different settings.

Bollinger bands settings for scalping

In scalping, the moving average line period should be close to 10, and the optimum standard deviation value will be 1.5.

Bollinger bands settings for day trading

In day trading, the period of moving the average line should be close to 20, and the optimum standard deviation value will be 2.

Bollinger bands settings for swing trading

Swing trading is considered the most profitable type because of more minor psychological effects. The moving average line in swing trading will be 50, and the standard deviation value will be 2.5.

Bollinger bands settings for position trading

Position trading is the long-term type of trading. The period of moving the average line in position trading will be close to 200, and the standard deviation value will be 2.5.

Table of different settings of Bollinger bands

| Type of Trading | Standard Deviation | Moving Average Period |

|---|---|---|

| Scalping | 1.5 | 10 |

| Day trading | 2.0 | 20 |

| Swing trading | 2.5 | 50 |

| Position trading | 2.5 | 200 |

Conclusion

There is a whole reason behind the usage of the above settings. The Bollinger band is the best tool for beginners and intermediate traders to trade efficiently. You can also increase the probability of winning by adding price action with Bollinger bands.

I recommend you backtest the results by applying the above settings before using them on a live account.